NetFlix 2002 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2002 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The increase in the fixed award compensation expense was attributable to the issuance of options in 2002, prior to our initial public offering, with exercise prices below the fair value of our

common stock. Since our initial public offering, there is no longer any difference between fair market value and the exercise price for new option grants and as a result no new deferred

stock−based compensation has or is expected to arise from new awards. Consequently, we expect our future stock−based compensation expense will relate to existing awards.

The increase in stock−based compensation expense related to variable awards was due to a full year of vesting for the variable awards, repriced in August of 2001, as compared to a partial

year of vesting in 2001 partially offset by a decrease in the fair value of our common stock during 2002.

Interest and Other Income (Expense), Net

Interest and other expense, net increased substantially from ($1.4 million) in 2001 to ($10.3 million) in 2002. This increase was attributable primarily to a one−time non−cash charge of $10.7

million associated with our early repayment, triggered by the consummation of our initial public offering in May 2002, of all outstanding indebtedness under our subordinated promissory

notes related to the acceleration of the accretion of the unamortized discount.

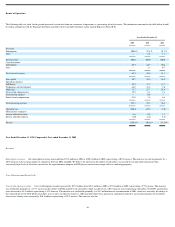

Year Ended December 31, 2000 Compared to Year Ended December 31, 2001

Revenues

Subscription revenues . Our subscription revenues increased from $35.9 million in 2000 to $74.3 million in 2001, representing a 107% increase. This increase was driven primarily by an

88% increase in the average number of subscribers between 2000 and 2001. We believe the increase in the number of subscribers was caused by our unrivalled selection of titles, consistently

high levels of subscriber satisfaction, the rapid consumer adoption of DVD players and our increasingly effective marketing programs. In addition, part of the increase was due to a $4.00

increase in the monthly subscription fee charged to some of our subscribers beginning in October 2000.

Cost of Revenues and Gross Profit

Cost of subscription revenues. Cost of subscription revenues increased by $24.2 million from $24.9 million in 2000 to $49.1 million in 2001, representing a 97% increase. This increase

was attributable primarily to 82% increase in the number of DVDs mailed to our subscribers which was driven by a 94% increase in average paying subscribers. Our revenue sharing costs

increased by $11.4 million, representing a 816% increase. This increase was due primarily to a substantial increase in the percentage of titles subject to revenue sharing agreements mailed to

our subscribers. Our DVD amortization costs increased by $8.1 million, representing a 70% increase. This increase was attributable primarily to the decrease in the period over which we

amortize the cost of our library. Our postage and packaging costs increased by $3.3 million, representing a 29% increase. This increase was attributable primarily to an increase in the number

of DVDs mailed to our subscribers, partially offset by a decrease in the postage rate per title as a result of packaging improvements. Our amortization of intangible assets increased by $1.4

million, representing a 321% increase. This increase was attributable to a full year of amortization in 2001 as compared to a partial year of amortization in 2000, additional deferred charges

for two new revenue sharing agreements in 2001 and increases in deferred charges caused by our obligation to issue additional equity securities to these studios.

Gross profit . Our gross profit increased from $11.0 million in 2000 to $26.0 million in 2001, representing a 136% increase and gross profit percentages of 31% in 2000 and 34% in 2001.

Our gross profit percentages increased primarily as a result of the growth in our subscription revenues and a decrease in our direct incremental costs of providing those subscription services.

18