NetFlix 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

efforts, business plans, operating performance and condition of the capital markets at the time we seek financing. We cannot assure you that additional financing will be available to us on

favorable terms when required, or at all. If we raise additional funds through the issuance of equity, equity−linked or debt securities, those securities may have rights, preferences or

privileges senior to the rights of our common stock, and our stockholders may experience dilution. See “Risks Related to Our Business” and “Risks Related to Our Ownership.”

Net cash used in operating activities was $22.7 million in 2000. Net cash provided by operating activities was $4.8 million in 2001 and $40.1 million in 2002. Net cash used in operating

activities in 2000 was primarily attributable to a net loss of $57.4 million and an increase in prepaid and other current assets, partially offset by deferred compensation expense, depreciation

and amortization expense, non−cash interest expenses, increases in accounts payable, accrued expenses and deferred revenue. Net cash provided by operating activities in 2001 was primarily

attributable to an increase in revenue, a decrease in operating expenses and an increase in accounts payable. Net cash provided by operating activities in 2002 was attributable primarily to a

$16.7 million reduction in net loss due to revenues growing at a much faster rate than operating expenses, offset by a $3.3 million reduction in depreciation and amortization, a $4.1 million

increase in non−cash stock−based compensation, a $10.4 million increase in non−cash interest expense, and a $9.3 million increase in operating assets and liabilities, offset by a $1.7 million

gain on disposal of used DVDs.

Net cash used in investing activities was $25.0 million in 2000, $12.7 million in 2001 and $67.3 million in 2002. Net cash used in investing activities in 2000 was primarily attributable to our

acquisition of titles for our library and property and equipment, partially offset by proceeds from the sale of short−term investments. Net cash used in investing activities in 2001 was

primarily attributable to our acquisition of titles for our library and property and equipment. The 63% decrease in cash used to acquire DVDs in 2001 from 2000, primarily reflects the

reduced cash requirements to acquire DVDs under our revenue sharing agreements. Net cash used in investing activities in 2002 was attributable primarily to a $43.0 million purchase of

short−term investments with a portion of our initial public offering proceeds and $24.1 million related to the acquisition of titles for our DVD library. While DVD acquisition expenditures

are classified as cash flows from investing activities you may wish to consider these together with cash flows from operating activities.

Net cash provided by financing activities was $48.4 million in 2000, $9.1 million in 2001 and $70.9 million in 2002. Net cash provided by financing activities in 2000 was primarily

attributable to proceeds from the sale of our Series E Convertible Preferred Stock, partially offset by payments on notes payable and capital lease obligations. Net cash provided by financing

activities in 2001 was primarily attributable to proceeds from the sale of common stock warrants and subordinated promissory notes, partially offset by payments on notes payable and capital

lease obligations. Net cash provided by financing activities in 2002 was attributable primarily to proceeds from the sale of our common stock in our initial public offering that raised net

proceeds of $86.2 million, partially offset by the repayment of $14.2 million on our subordinated notes payable and $2.9 million on our other notes payable and capital lease obligations.

Commitments and Contingencies

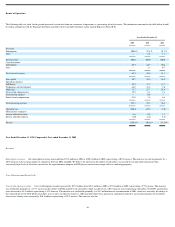

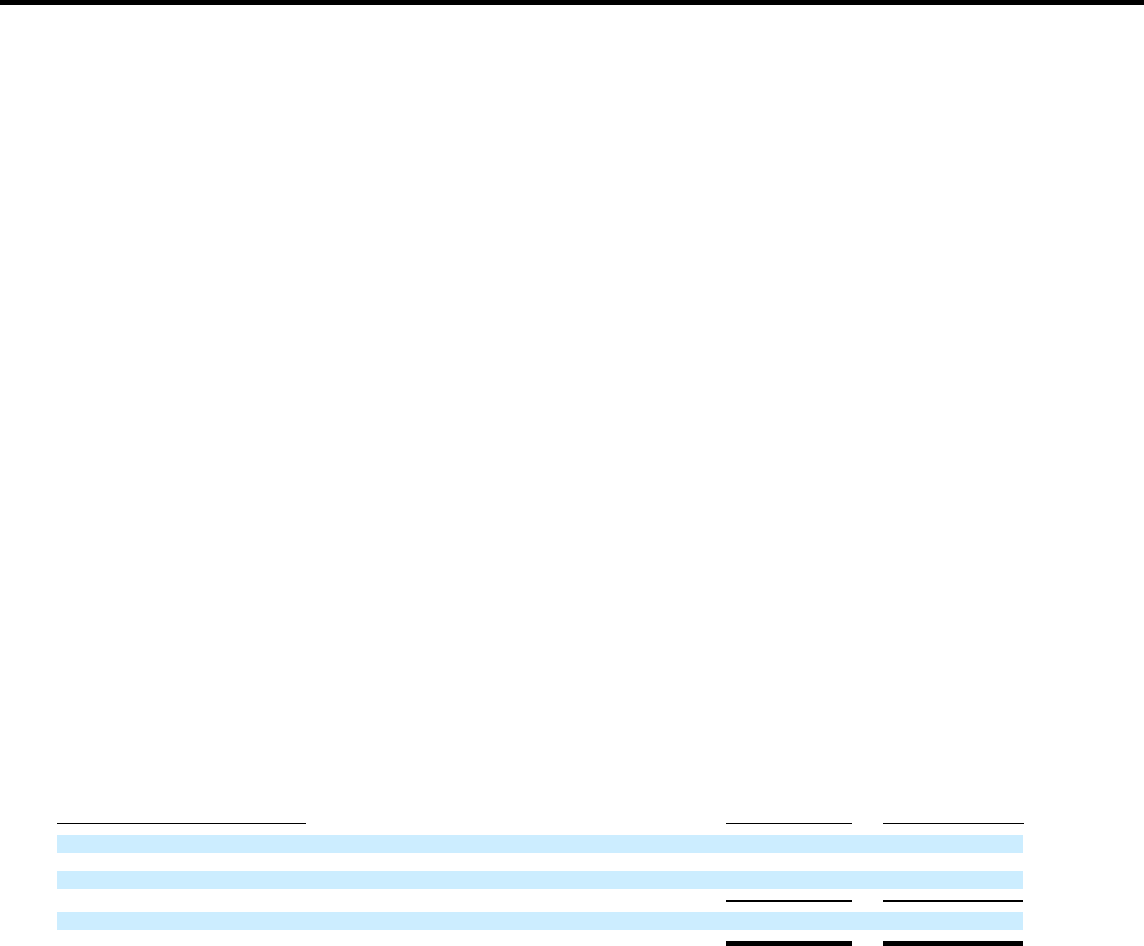

We had no material commitments for capital expenditures as December 31, 2002. We have lease obligations under noncancelable operating leases and capital leases with various expiration

dates through March 2005. Future minimum lease payments under noncancelable operating and capital leases as of December 31, 2002, are as follows (in thousands):

Year Ending December 31, Capital Leases Operating Leases

2003 $ 1,326 $ 2,952

2004 462 2,640

2005 56 1,466

Total minimum payments $ 1,844 $ 7,058

20