NetFlix 2002 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2002 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Years Ended December 31, 2000, 2001 and 2002

(in thousands, except share, per share and per DVD data)

obligations under guarantees issued. The Interpretation also clarifies that a guarantor is required to recognize, at inception of a guarantee, a liability for the fair value of the obligation

undertaken. This initial recognition and measurement provisions of the Interpretation are applicable to guarantees issued or modified after December 31, 2002 and are not expected to have a

material effect on the Company’s financial statements. The disclosure requirements are effective for financial statements of interim or annual periods ending after December 15, 2002.

In January 2003, the FASB issued Interpretation No. 46 , Consolidation of Variable Interest Entities, an interpretation of ARB No. 51 . This Interpretation addresses the consolidation by

business enterprises of variable interest entities as defined in the Interpretation. The Interpretation applies immediately to variable interests in variable interest entities created after January

31, 2003. For public enterprises, such as the Company, with a variable interest in a variable interest entity created before February 1, 2003, the Interpretation is applied to the enterprise no

later than the beginning of the first interim or annual reporting period beginning after June 15, 2003. The application of this Interpretation is not expected to have a material effect on the

Company’s financial statements. The Interpretation requires certain disclosures in financial statements issued after January 31, 2003 if it is reasonably possible that the Company will

consolidate or disclose information about variable interest entities when the Interpretation becomes effective.

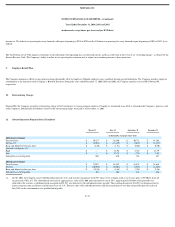

Stock split

On May 17, 2002, the Company amended its Certificate of Incorporation to effect a one−for−three reverse stock split of the Company’s common stock. Accordingly, all share and per share

amounts for the Company’s common stock including common stock options, common stock warrants and net loss per common share information have been restated to retroactively reflect

the stock split.

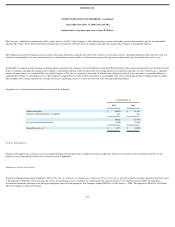

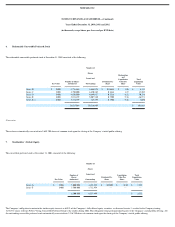

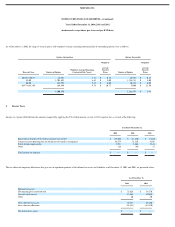

2. Property and Equipment, Net

Property and equipment consisted of the following:

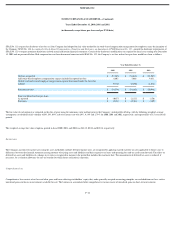

As of December 31,

2001 2002

Computer equipment $ 9,245 $ 10,612

Internal−use software 5,285 6,660

Furniture and fixtures 2,033 2,616

Leasehold improvements 1,627 1,636

18,190 21,524

Less accumulated depreciation (9,985) (15,904)

$ 8,205 $ 5,620

Property and equipment includes approximately $5,554 and $6,173 of assets under capital leases as of December 31, 2001 and 2002, respectively. Accumulated amortization of assets under

these leases totaled $3,701 and $5,176 as of December 31, 2001 and 2002, respectively. Internal−use software includes approximately $2,795 and $3,948 of internally incurred capitalized

software development costs as of December 31, 2001 and 2002, respectively. Accumulated amortization of capitalized software development costs totaled $1,835 and $3,024 as of December

31, 2001 and 2002, respectively.

F−15