NetFlix 2002 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2002 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

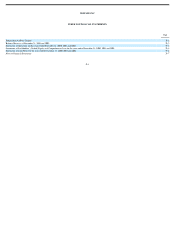

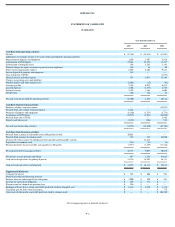

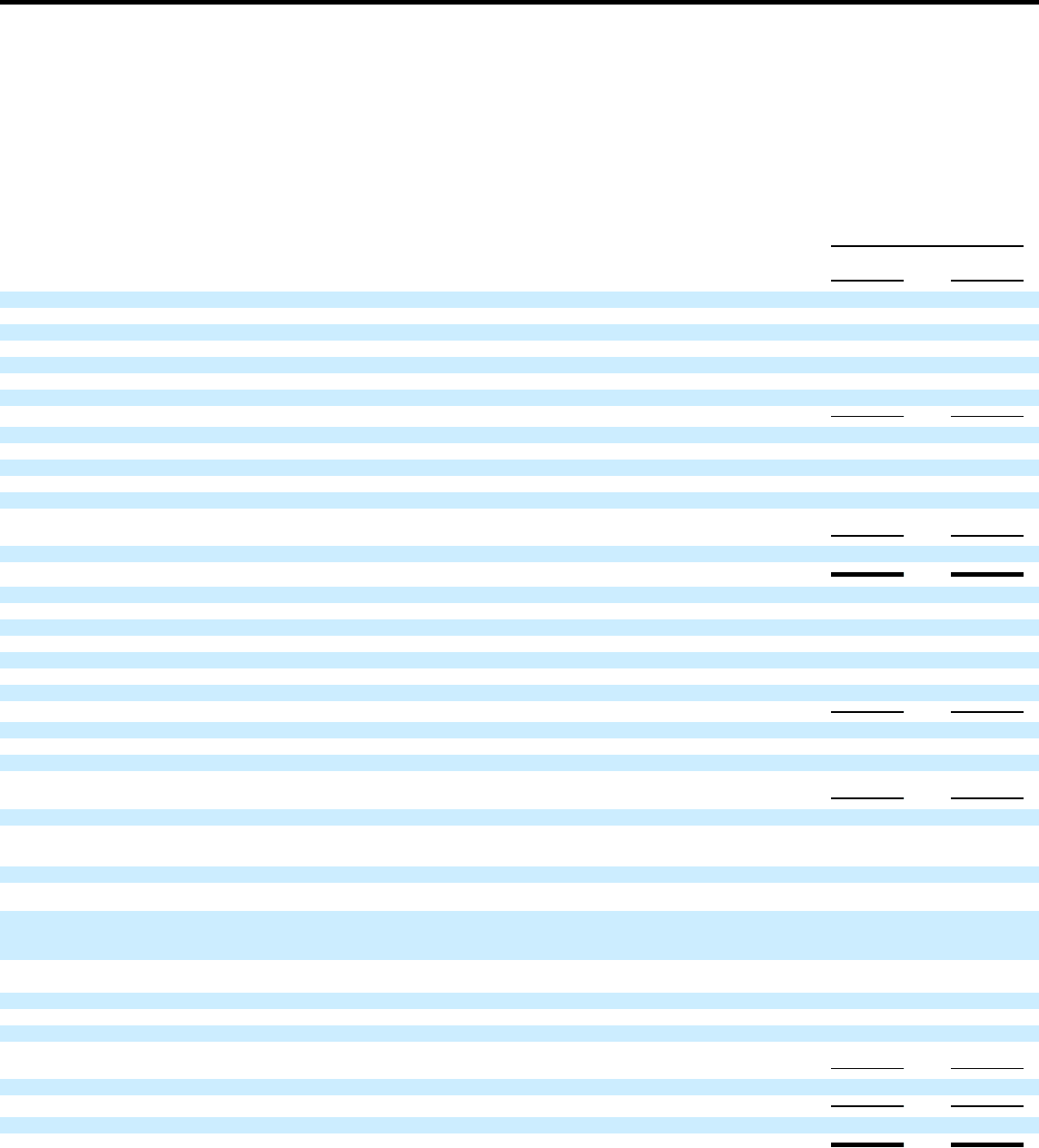

NETFLIX, INC.

BALANCE SHEETS

(in thousands, except share and per share data)

As of December 31,

2001 2002

Assets

Current assets:

Cash and cash equivalents $ 16,131 $ 59,814

Short−term investments — 43,796

Prepaid expenses 1,019 2,753

Prepaid revenue sharing expenses 732 303

Other current assets 1,670 409

Total current assets 19,552 107,075

DVD library, net 3,633 9,972

Intangible assets, net 7,917 6,094

Property and equipment, net 8,205 5,620

Deposits 1,677 1,690

Other assets 646 79

Total assets $ 41,630 $ 130,530

Liabilities and Stockholders’ (Deficit) Equity

Current liabilities:

Accounts payable $ 13,715 $ 20,350

Accrued expenses 4,544 9,102

Deferred revenue 4,937 9,743

Current portion of capital lease obligations 1,345 1,231

Notes payable 1,667 —

Total current liabilities 26,208 40,426

Deferred rent 240 288

Capital lease obligations, less current portion 1,057 460

Subordinated notes payable, net of unamortized discount of $10,851 at December 31, 2001 2,799 —

Total liabilities 30,304 41,174

Commitments and contingencies (note 5)

Redeemable convertible preferred stock 101,830

Stockholders’ (deficit) equity:

Convertible preferred stock, $0.001 par value; 8,500,000 and 10,000,000 shares authorized at December 31, 2001 and 2002, respectively;

6,157,499 and no shares issued and outstanding at December 31, 2001 and 2002, respectively; aggregate liquidation preference of $2,222 at

December 31, 2001 6 —

Common stock, $0.001 par value; 100,000,000 and 150,000,000 shares authorized at December 31, 2001 and 2002, respectively; 2,161,855 and

22,445,795 issued and outstanding at December 31, 2001 and 2002, respectively 2 22

Additional paid−in capital 52,479 259,172

Deferred stock−based compensation (5,725) (11,399)

Accumulated other comprehensive income — 774

Accumulated deficit (137,266) (159,213)

Total stockholders’ (deficit) equity (90,504) 89,356

Total liabilities and stockholders’ (deficit) equity $ 41,630 $ 130,530

See accompanying notes to financial statements.

F−3