Mazda 2015 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2015 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

have successively rolled out new-generation products

equipped with SKYACTIV TECHNOLOGY. These new-

generation products have had strong receptions in

Japan and overseas, and they are contributing to

increased sales volume and enhanced brand value. With

this robust product strength, we are improving transac-

tion prices and curtailing incentives through a policy of

right-price sales. These efforts are making a major con-

tribution to earnings.

In terms of accelerating further cost improvement

through Monotsukuri Innovation, we have integrated

planning that spans models, classes, and segments

to create common development and manufacturing

processes that makes it possible to develop and

manufacture a variety of products more efficiently. Our

new products, which take full advantage of these

“Monotsukuri” innovations, not only achieve excellent

driving performance and fuel efficiency, they are meet-

ing all our expectations in terms of cost competitiveness

as well.

We have also made steady progress in reinforcing

our business in emerging markets and establishing a

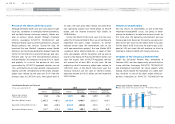

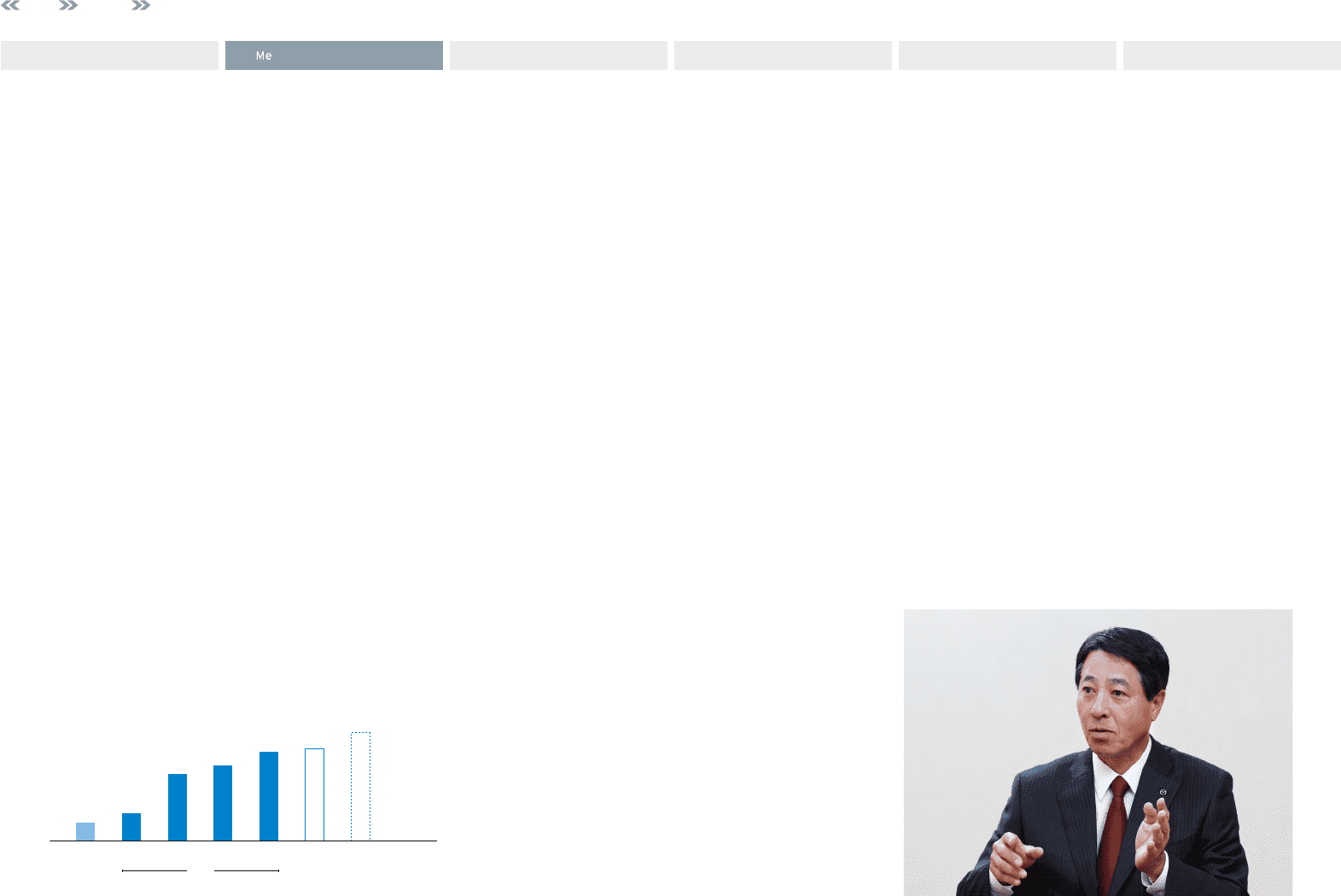

global production foundation. Our new plant in Mexico

commenced operations in January 2014, and since

then it has been steadily increasing production vol-

umes, with 140,000 units produced in the March 2015

fiscal year. We plan to raise the plant’s production to

230,000 units in the March 2016 fiscal year. The new

transmission plant in Thailand is off to a solid start

since beginning the mass production of SKYACTIV-

DRIVE transmissions in January 2015. We are also

strengthening our business in emerging markets by

creating production systems in Russia, Malaysia, and

Vietnam. We will maintain the size of our production

in Japan while steadily establishing a globally bal-

anced production and supply foundation.

With regard to promoting global alliances, our

strategy is to enter into mutually complementary alli-

ances optimal to each product, technology, and region.

In June 2015, the new Mexico plant began manufac-

turing compact cars for Toyota. We also plan to begin

the production of a two-seater convertible sports car

for Fiat Chrysler Automobiles during the March 2016

fiscal year.

These efforts show our steady progress under the

Structural Reform Plan in each area of products, sales,

production, and alliances, and this progress is trans-

lating to enhanced brand value.

Structural Reform Stage 2

We have announced a new medium-term business

plan—Structural Reform Stage 2—covering the period

from the March 2017 to the March 2019 fiscal years. To

date, we have steadily implemented the major initia-

tives under the Structural Reform Plan, but we recog-

nize that there is still room for improvement in each

area. Under Structural Reform Stage 2, our main focus

will be on further strengthening these initiatives while

addressing changes in the business environment in

each region, including trends in demand by market and

segment, market trends including exchange rates and

crude oil prices, and environmental regulations. Our

final-year management targets for the March 2019

fiscal year are for global sales volume of 1.65 million

units, an operating income ratio of at least 7%, an

equity ratio of at least 45%, and a dividend payout

ratio of at least 20%.

Message from President and CEO: To Shareholders and Investors

(Forecast)

2014 2015 2016

4Q 1Q 2Q 3Q 4Q 1Q 2Q~

10 15

36 41 48 54

Production Volume at the New Mexico Plant

(Thousands of units)

(Years ended

March 31)

Mazda Annual Report 2015

06

ssage from Management

CONTENTS

Foundations Underpinning

Sustainable Growth

Growth Strategy

Introduction

Review of Operations

Corporate Data