Mazda 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Review and Analysis

March 2015 Fiscal Year Review of

Operations

Operating Environment

The operating environment for the Mazda

Group in the March 2015 fi scal year—the year

ended March 31, 2015—showed many ele-

ments of uncertainty, including slowdowns in

emerging market economies and instability in

foreign exchange markets, but the overall

tone was one of a gradual improvement.

Overseas, although China’s economic growth

slowed, the United States showed a steady

recovery, and the beginning of a rebound was

evident in the European economy as a result

of monetary easing. In Japan, retail consump-

tion remained weak in the wake of an increase

in the consumption tax rate, but the direction

of the economy pointed toward a clear recov-

ery. Against this backdrop, the Mazda Group

pursued structural reforms leveraging its

SKYACTIV TECHNOLOGY, and it worked to

enhance brand value by providing attractive

products and services unique to Mazda.

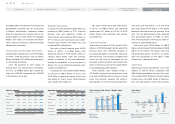

Global Sales Volume

Mazda’s global sales volume in the March 2015

fi scal year rose 5.0% from the previous year,

to 1,397,000 units. In addition to continued

strong sales of the Mazda CX-5 and Mazda3

(Japanese name: Mazda Axela), the new model

of the Mazda2 (Japanese name: Mazda

Demio), which was introduced during the year,

contributed to this growth in sales volume.

By market, sales volume in Japan declined

7.8% from the previous year, to 225,000

units, as a result of the effect of the consump-

tion tax increase, but recent sales have shown

a recovery due to solid sales of the new Demio

and the launch of the new CX-3 in February

2015. Overseas, sales in North America

rose 8.9%, to 425,000 units. Solid sales of

main models, including the CX-5, the Mazda6

(Japanese name: Mazda Atenza), and the

Mazda3, led to sales growth in the United

States, and record sales were registered in

Mexico as well. In Europe, fi rm sales of the

Mazda3 contributed to a 10.8% increase in

sales volume, to 229,000 units, with Mazda’s

sales in the major markets of Germany and

the United Kingdom outpacing the growth of

the overall market. In China, sales grew 9.2%,

to 215,000 units, boosted by the locally pro-

duced CX-5 and Mazda3. In other markets,

although weak demand impacted sales in

some markets such as Thailand, solid sales of

the CX-5 and Mazda3 led to an overall gain of

3.4%, to 303,000 units.

Consolidated wholesales rose 8.1% from the

previous year, to 1,205,000 units.

Net Sales

Net sales totaled ¥3,033.9 billion, an increase of

¥341.7 billion, or 12.7%, from the previous year,

refl ecting global sales growth of SKYACTIV-

equipped models. By region, domestic sales

posted a 5.8% decline, to ¥617.4 billion, and

overseas sales registered an 18.7% increase, to

¥2,416.5 billion.

By product, vehicle sales rose ¥319.7 billion,

or 14.7%, to ¥2,500.4 billion, stemming from

growth in unit sales and an improved product

mix. Sales of knockdown parts for overseas pro-

duction expanded ¥8.6 billion, or 12.3%, to

¥79.0 billion, refl ecting increased shipments to

China. Sales of parts rose ¥25.2 billion, or

12.2%, to ¥231.7 billion, while other sales de-

clined ¥11.9 billion, or 5.1%, to ¥222.7 billion.

Operating Income

Operating income totaled ¥202.9 billion,

marking an increase from the previous year

of ¥20.8 billion, or 11.4%. In addition to higher

spending to reinforce sales promotion activi-

ties, increased investments for future growth

Sales Trend by Major Markets

(Thousands of units)

1,397

2011 2012 2013 2014 2015

Other markets

China

Europe

North America

Japan

225

425

229

215

303

1,273 1,247 1,235

206 206 216

1,331

244

391

207

196

293

372

172

175

300

372

183

223

263

342

212

236

277

(Years ended March 31)

3,033.9

2,416.5

617.4

2,325.7

1,784.2

541.5

2,033.1

1,472.9

560.2

2,692.2

2,036.5

655.7

2,205.3

1,617.3

588.0

Net Sales

2011 2012 2013 2014 2015

(Years ended March 31)

158.8

202.9

2011 2012 2013 2014 2015

Operating Income (Loss) / Net Income (Loss)

(60.0) (38.7)

23.8 53.934.3

(107.7)

135.7

182.1

Operating Income (Loss)

Net Income (Loss)

Improvement

Deterioration

(Years ended March 31) (Years ended March 31)

+48.6

+20.8

+17.0 +17.5

(15.0) (47.3)

182.1

202.9

Operating Income Change

2014 2015

Mazda Annual Report 2015

36

C

CONTENTS

Growth Strategy

Message from Management

Introduction

Review of Operations

Foundations Underpinning

Sustainable Growth