Mazda 2015 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2015 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

included higher investment for research and

development and fi xed costs for a new plant

in Mexico. Nevertheless, operating income

grew on expanded sales volume and an im-

proved model mix from SKYACTIV-equipped

models, the effects of exchange rate move-

ments, and cost reductions achieved through

Monotsukuri Innovation.

Income before Income Taxes, Net Income

Income before income taxes rose ¥111.9 billion,

or 114.9%, from the previous year, to ¥209.3

billion, including a ¥17.2 billion gain from equity

in net income of affi liates.

After the payment of ¥47.7 billion of

income taxes, net income grew ¥23.1 billion,

or 17.0%, to ¥158.8 billion. Net income per

share was ¥265.64, compared with ¥226.99

in the previous fi scal year.

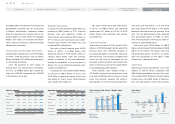

Segment Information

In Japan, net sales totaled ¥2,528.1 billion, an

increase of ¥264.9 billion, or 11.7%, from the

previous year, with operating income of

¥142.4 billion, which declined ¥31.1 billion, or

17.9%. These results were mainly due to dete-

riorated sales volume and model mix, and

increased R&D expenditures.

Net sales in North America grew ¥412.5

billion, or 48.9%, to ¥1,256.1 billion, with

operating income of ¥37.9 billion, which in-

creased ¥36.6 billion from the previous

period. In addition to full-scale operations

leading to profi tability at the new plant in

Mexico, this result refl ected improved sales

volume and model mix.

In Europe, net sales totaled ¥622.9 billion,

an increase of ¥82.4 billion, or 15.2%, and

¥14.9 billion in operating income, which rose

¥6.5 billion, or 76.3%, mainly from improved

sales volume and model mix.

Net sales in other areas rose ¥69.2 billion,

or 16.7%, to ¥483.4 billion, and operating

income grew ¥7.7 billion, or 132.5%, to ¥13.5

billion, mainly from improved sales volume

and model mix.

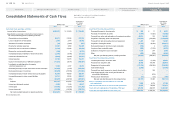

Financial Position

Total assets as of March 31, 2015, were ¥2,473.3

billion, a ¥227.3 billion gain from the end of the

previous fi scal year, refl ecting increases in

cash and time deposits, inventories, and tangi-

ble fi xed assets. The increase in tangible fi xed

assets was the result of investments for the

new plant in Mexico and the new transmission

plant in Thailand, as part of the establishment

of our global production footprint.

Total liabilities were ¥1,582.0 billion, a

¥12.8 billion increase from the previous fi scal

year-end, stemming from an increase in trade

notes and accounts payable. Net interest-

bearing debt, or interest-bearing debt minus

cash and cash equivalents, as of the fi scal

year-end totaled ¥171.9 billion, a ¥91.1 billion

decrease from the end of the previous fi scal

year. The net debt-to-equity ratio improved

20.0 percentage points, to 19.8%, or 15.1%

after the recognition of the equity credit at-

tributes of subordinated loans.

Net assets grew ¥214.5 billion, to ¥891.3

billion, which included the recording of ¥158.8

billion of net income. The equity ratio rose

5.8 percentage points, to 35.2%, or 36.6%

after the recognition of the equity credit

attributes of subordinated loans.

Cash Flows

Operating activities provided net cash in the

amount of ¥204.5 billion, compared with

¥136.4 billion provided in previous fi scal year.

This included ¥209.3 billion of income before

income taxes and ¥68.9 billion of deprecia-

tion and amortization, which were partially

Sales by Segment* (Billions of yen)

(Years ended

March 31) 2011 2012 2013 2014 2015

Japan 1,999.5 1,745.0 1,893.6 2,263.3 2,528.1

North America 631.0 571.6 650.0 843.6 1,256.1

Europe 438.2 360.4 354.8 540.5 622.9

Other markets 310.4 294.2 418.7 414.2 483.4

Adjustment (1,053.4) (938.1) (1,111.8) (1,369.4) (1,856.7)

Consolidated 2,325.7 2,033.1 2,205.3 2,692.2 3,033.9

Operating Income (Loss) by Segment* (Billions of yen)

(Years ended

March 31) 2011 2012 2013 2014 2015

Japan 32.6 (18.4) 108.4 173.5 142.4

North America (31.7) (40.3) (48.9) 1.3 37.9

Europe 7.9 5.6 3.1 8.5 14.9

Other markets 12.8 10.1 16.8 5.8 13.5

Adjustment 2.2 4.3 (25.5) (7.0) (5.8)

Consolidated 23.8 (38.7) 53.9 182.1 202.9

108.9

(95.5)

204.5

2011 2012 2013 2014 2015

Cash Flows

(Billions of yen)

1.6

(79.4)

8.7

(13.7) (9.1)

(70.3)

15.3

49.0

(40.3)

16.3

(120.1)

136.4

891.3

2,473.3

2011 2012 2013 2014 2015

35.2

1,771.8 1,915.9 1,978.6

513.2

474.4

430.5

676.8

2,246.0

29.4

25.1

24.5

24.2

Total Assets / Net Assets / Equity Ratio

(Billions of yen / %)

Total Assets

Net Assets

Equity Ratio

Cash Flow from Operating Activities

Cash Flow from Investing Activities

Free Cash Flow

(As of March 31) (Years ended March 31)

* Net sales by geographic area based on reportable segments * Operating income by geographic area based on reportable segments

Mazda Annual Report 2015

37

C

CONTENTS

Growth Strategy

Message from Management

Introduction

Review of Operations

Foundations Underpinning

Sustainable Growth