Mazda 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

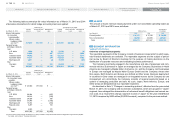

Basis of measuring fair value of financial instruments

The fair values of some financial instruments are based on market prices. When market

prices are unavailable, the fair values are based on reasonably estimated values. The esti-

mated values may vary depending on the assumptions and variables used in the estimation.

Assets

1) Trade notes and accounts receivable

Trade notes and accounts receivable with short maturities are stated at carrying value as it

approximates fair value. The fair values of other receivables are calculated by grouping the

receivables according to their time to maturity, and then by discounting the amount of those

receivables by group to present values. The discount rates used in computing the present

values reflect the time to maturity as well as credit risk.

2) Investment securities

As for listed stocks included in investment securities, their quoted prices on the stock

exchange are used as their fair values.

For notes on securities by classification, refer to “Securities” under Note 2, “Significant

Accounting Policies”, and Note 5, “Securities”.

3) Long-term loans receivable

Long-term loans receivable consist of variable interest loans. As such, the interest rates on

these loans reflect the market rates of interest within short periods of time. Also, the credit

standings of borrowers of these loans have not changed significantly since the execution of

these loans. Accordingly, the carrying values are used as the fair values of these loans

receivable.

For loans receivable at a high risk, the fair value is calculated mainly based on amounts

estimated to be collectible through collateral and guarantees.

Liabilities

1) Trade notes and accounts payable, 2) Other accounts payable, and 3) Short-term debt

These payables are settled within short periods of time. Hence, their carrying values

approximate their fair values. Accordingly, carrying values are used as the fair values of

these payables.

4) Long-term debt

a) Bonds payable

The fair value of bonds issued by the Group is based on the market price where such a

price is available. Otherwise, the sum of the present value of principal and interest pay-

ments is used as the fair value of bonds payable. The discount rates used in computing

the present value reflect the time to maturity of the bonds as well as credit risk.

b) Long-term loans payable and c) Finance lease obligations

The fair value of these liabilities is calculated by the sum of the principal and interest

payments discounted to present value, using the imputed interest rate that would be

required to newly execute a similar borrowing or lease transaction.

For some long-term loans payable with variable interest rates, interest rate swaps are

used as a hedge against interest rate fluctuations. When such interest rate swaps meet

certain hedging criteria, the net amount to be paid or received under the interest rate

swap contract is added to or deducted from the interest on the long-term loans payable.

In such cases, the resulting net interest on the long-term loans payable is used in cal-

culating the present value.

Derivative instruments

Refer to Note 15, “Derivative Financial Instruments and Hedging Transactions”.

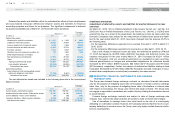

Scheduled amounts of receivables were as follows:

Millions of yen Thousands of U.S. dollars

As of March 31, 2015 Within 1 year

Over 1 year,

within 5

years

Over 5 years,

within 10

years

Over 10

years Within 1 year

Over 1 year,

within 5

years

Over 5 years,

within 10

years

Over 10

years

T rade notes and

accounts receivable ¥215,161 ¥ — ¥ — ¥ — $1,793,008 $ — $ — $ —

L ong-term loans

receivable 354 5,365 366 305 2,950 44,708 3,050 2,542

Total ¥215,515 ¥5,365 ¥366 ¥305 $1,795,958 $44,708 $3,050 $2,542

Millions of yen

As of March 31, 2014 Within 1 year

Over 1 year,

within 5

years

Over 5 years,

within 10

years

Over 10

years

T rade notes and

accounts receivable

¥180,544 ¥ — ¥ — ¥ —

L ong-term loans

receivable

278 5,632 582 337

Total

¥180,822 ¥5,632 ¥582 ¥337

For the schedule of repayment of long-term debt after the consolidated balance sheet

date, refer to Note 9, “Short-Term Debt and Long-Term Debt”.

Mazda Annual Report 2015

51

C

CONTENTS

Growth Strategy

Message from Management

Introduction

Review of Operations

Foundations Underpinning

Sustainable Growth