Mazda 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

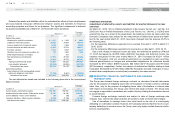

SHORT-TERM DEBT AND LONG-TERM DEBT

Short-term debt as of March 31, 2015 and 2014 consisted of loans, principally from banks

with interest averaging 1.42% and 1.39% for the respective years.

Long-term debt as of March 31, 2015 and 2014 consisted of the following:

Millions of yen

Thousands of

U.S. dollars

As of March 31 2015 2014 2015

Domestic unsecured bonds due serially 2014 through

2019 at rate of 0.25% to 1.87% per annum ¥ 40,450(*)

¥ 40,550

$ 337,083

Loans principally from banks, maturing through 2072:

Secured loans 48,946

81,004

407,883

Unsecured loans 489,964

510,938

4,083,034

Lease obligations, maturing through 2022 4,982

4,960

41,517

Sub total 584,342

637,452

4,869,517

Amount due within one year (96,132)

(109,715)

(801,100)

Total ¥488,210

¥ 527,737

$4,068,417

(*) As of March 31, 2015, certain of these unsecured bonds amounting to ¥450 million ($3,750 thousand) are bank- guaranteed under the

condition that assets are pledged to the bank as collateral by the issuer of the bonds.

The annual interest rates applicable to long-term loans and lease obligations outstand-

ing averaged 1.68% and 1.51%, respectively, for obligations due within one year and

1.95% and 1.47%, respectively, for obligations due after one year at March 31, 2015.

The annual interest rates applicable to long-term loans and lease obligations outstand-

ing averaged 1.29% and 1.95%, respectively, for obligations due within one year and

1.89% and 2.01%, respectively, for obligations due after one year at March 31, 2014.

As is customary in Japan, general agreements with banks include provisions that secu-

rity and guarantees will be provided if requested by banks. Banks have the right to offset

cash deposited with them against any debt or obligation that becomes due and, in the case

of default or certain other specified events, against all debts payable to banks.

The annual maturities of long-term debt at March 31, 2015 were as follows:

Year ending March 31 Millions of yen

Thousands of

U.S. dollars

2016

¥ 96,132 $ 801,100

2017

144,066 1,200,550

2018

91,647 763,725

2019

97,157 809,642

2020

46,835 390,292

Thereafter

108,505 904,208

Total

¥584,342 $4,869,517

The assets pledged as collateral for short-term debt of ¥33,973 million ($283,108 thou-

sand) and ¥30,412 million, and long-term debt of ¥49,396 million ($411,633 thousand) and

¥81,554 million at March 31, 2015 and 2014, respectively, were as follows:

Millions of yen

Thousands of

U.S. dollars

As of March 31 2015 2014 2015

Property, plant and equipment, at net book value ¥412,999

¥396,511

$3,441,658

Inventories 61,797

70,739

514,975

Other 63,498

63,247

529,150

Total ¥538,294

¥530,497

$4,485,783

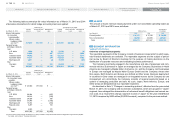

10 EMPLOYEES’ SEVERANCE AND RETIREMENT BENEFITS

The Group has contributory defined contribution plans and defined benefit plans, and non-

contributory defined benefit plans. For the accounting policies for retirement benefits, refer

to Note 2, “Employees’ severance and retirement benefits”.

Reconciliations of beginning and ending balances of the retirement benefit obligations

and the plan assets for the years ended March 31, 2015 and 2014 were as follows:

Millions of yen

Thousands of

U.S. dollars

For the years ended March 31 2015 2014 2015

Movements in retirement benefit obligations:

Balance at beginning of year ¥301,619

¥300,322

$2,513,492

C umulative effects of changes in

accounting policies (3,082)

—

(25,683)

Restated balance 298,537

300,322

2,487,809

Service cost 9,900

10,417

82,500

Interest cost 4,611

4,694

38,425

Actuarial gains/(losses) 14,543

6,819

121,192

Benefits paid (16,074)

(16,311)

(133,950)

Past service costs —

(7,456)

—

Other 2,735

3,134

22,792

Balance at end of year ¥314,252

¥301,619

$2,618,768

Mazda Annual Report 2015

53

C

CONTENTS

Growth Strategy

Message from Management

Introduction

Review of Operations

Foundations Underpinning

Sustainable Growth