Mazda 2015 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2015 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

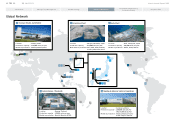

Mexico fully operational, we are making steady progress

in this area with increased overseas production volume

and stronger resistance to movements in the U.S. dollar.

Due to a high ratio of domestic production, the effect of

exchange rate fluctuations on our financial results has

been an issue for Mazda in the past. We have established a

global production footprint under the Structural Reform

Plan. The new Mexico plant commenced operations in

January 2014 and is producing the Mazda3 and Mazda2 for

shipment to North America, Europe, and Central and South

America. The plant produced 140,000 units in the March

2015 fiscal year, which was as planned, and in the March

2016 fiscal year we plan to increase this number to 230,000

units, which includes the production and supply of compact

cars to Toyota. Full-scale operations at the new Mexico

plant have reduced our sensitivity to U.S. dollar movements

as planned. In this way, we have had reasonable success in

terms of our exposure to major currencies, but the effect

on results from unstable emerging market currencies

remains an issue.

We will continue to pursue appropriate exchange rate

exposure management and optimal global sourcing, and

by maximizing capacity utilization at overseas production

sites we will quickly reduce production costs without being

affected by temporary fluctuations in exchange rates,

with the aim of higher profitability over the medium-to-

long term.

Q4 What are your plans with regard to capital invest-

ment and R&D expenditures going forward?

While we accelerate and strengthen the development of

next-generation technologies for the future, we intend to

make technological development and capital investment for

production more efficient through Monotsukuri Innovation.

At the same time, we will set ceilings for both capital and

R&D expenditures as a percentage of sales to make disci-

plined investments.

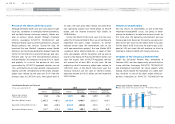

We have recently had a high level of capital expenditures,

surpassing ¥130.0 billion in both the March 2014 and March

2015 fiscal years, as we established the global production

foundation that included the construction of a new plant in

Mexico and a new transmission plant in Thailand. For the

March 2016 fiscal year, we will focus on investment for new

products, maintenance, and equipment upgrades, and we are

projecting capital expenditures of ¥105.0 billion. We have set

a ceiling for capital expenditures of 3.5% of net sales during

the period covered by Structural Reform Stage 2. We will also

make decisions regarding additional capacity expansion at

the appropriate time for further growth in sales volume in

the future.

We plan to increase R&D expenditures to ¥125.0 billion in

the March 2016 fiscal year, from ¥108.4 billion in the previ-

ous year, to comply with increasingly strict environmental

regulations around the world and to accelerate and

strengthen our development of next-generation technolo-

gies and vehicles, including SKYACTIV Generation 2 models.

The cap we have set for R&D expenditures is 4.0% of net

sales. Along with increasing the efficiency of technological

development and capital investment for production through

Monotsukuri Innovation, we will be disciplined in our invest-

ment under these ceilings.

Q5 What are your thoughts regarding corporate

governance?

We approach corporate governance as one of our most

important management issues for sustainable growth

and enhancement of corporate value in the medium-

and long-term.

We recognize that the further strengthening of our

corporate governance structure is one of the most impor-

tant management issues for our sustainable growth and

enhancement of corporate value in the medium- and long-

term. We have implemented a variety of measures to date,

including the creation of an environment in which full-time

and outside auditors are able to conduct appropriate audits

and the introduction of a system of outside directors, but

going forward we will strive to make our corporate gover-

nance structure even stronger. We will also continue to

engage in dialogue with shareholders and investors at

general shareholder meetings, business briefings, and

quarterly results announcements, and we continue to

release information in a timely and appropriate manner.

August 2015

Akira Marumoto

Representative Director and

Executive Vice President

Interview with the Executive Vice President

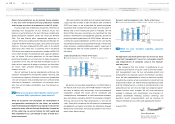

Capital Expenditures / Ratio of Net Sales

■ Capital Expenditures (Billions of yen) Ratio of Net Sales (%)

(Forecast)

(Forecast)

3.8 4.9

3.5 4.3 3.2

78.0

2012 2013 2014 20162015 2017~

2019

77.2

133.2 131.0

105.0

Research and Development Costs / Ratio of Net Sales

■

Research and Development Costs (Billions of yen) Ratio of Net Sales (%)

(Forecast)

(Forecast)

4.5 3.7

4.1 3.6 3.8

91.7 89.9 99.4 108.4 125.0

2012 2013 2014 20162015 2017~

2019

(Years ended March 31)

(Years ended March 31)

Mazda Annual Report 2015

09

Message from Management

CONTENTS

Foundations Underpinning

Sustainable Growth

Growth Strategy

Introduction

Review of Operations

Corporate Data