Mazda 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

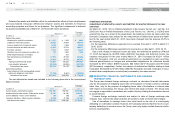

Deferred tax assets and liabilities reflect the estimated tax effects of loss carryforwards

and accumulated temporary differences between assets and liabilities for financial

accounting purposes and those for tax purposes. The significant components of deferred

tax assets and liabilities as of March 31, 2015 and 2014 were as follows:

Millions of yen

Thousands of

U.S. dollars

As of March 31 2015 2014 2015

Deferred tax assets:

Allowance for doubtful receivables ¥ 1,187

¥ 1,226

$ 9,892

Liability for retirement benefits 22,053

24,034

183,775

Loss on impairment of long-lived assets 4,186

4,539

34,883

Accrued bonuses and other reserves 26,906

33,734

224,217

Inventory valuation 6,873

5,659

57,275

Valuation loss on investment securities, etc. 121

1,405

1,008

Deferred gains/(losses) on hedges —

672

—

Net operating loss carryforwards 57,989

88,189

483,242

Other 53,665

36,770

447,207

Total gross deferred tax assets 172,980

196,228

1,441,499

Less valuation allowance (66,862)

(84,089)

(557,183)

Total deferred tax assets 106,118

112,139

884,316

Deferred tax liabilities:

A sset retirement cost corresponding to asset

retirement obligations, and others (13,159)

(5,841)

(109,658)

Net deferred tax assets ¥ 92,959

¥ 106,298

$ 774,658

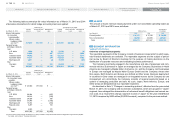

The net deferred tax assets are included in the following accounts in the consolidated

balance sheets:

Millions of yen

Thousands of

U.S. dollars

As of March 31 2015 2014 2015

Current assets—Deferred tax assets ¥76,758

¥54,897

$639,650

Investments and other assets—Deferred tax assets 25,784

54,189

214,867

Current liabilities—Other current liabilities (47)

(59)

(392)

Long-term liabilities—Other long-term liabilities (9,536)

(2,729)

(79,467)

Net deferred tax assets ¥92,959

¥106,298

$774,658

(Additional information)

(Adjustment of deferred tax assets and liabilities for enacted changes in tax laws

and rates)

On March 31, 2015, “Act on Partial Amendment of the Income Tax Act, etc.” (Act No. 9 of

2015) and “Act on Partial Amendment of the Local Tax Act, etc.” (Act No. 2 of 2015) were

enacted into law. As a result of the amendment, the statutory income tax rates, which the

Domestic Companies have utilized for the measurement of deferred tax assets and liabili-

ties for the year ended March 31, 2015, have been changed from the previous 35.4% to

the following rates.

– For the temporary differences expected to be reversed from April 1, 2015 to March 31,

2016: 32.8%

– For the temporary differences expected to be reversed on or after April 1, 2016: 32.1%

Due to this change in statutory income tax rates, net deferred tax assets as of March

31, 2015 decreased by ¥3,058 million ($25,483 thousand) and deferred income tax

expense recognized for the year ended March 31, 2015 increased by ¥3,211 million

($26,758 thousand). And net unrealized gain/(loss) on available-for-sale securities,

deferred gains/(losses) on hedges and accumulated adjustments for retirement benefit

increased by ¥118 million ($983 thousand), ¥26 million ($217 thousand) and ¥9 million

($75 thousand), respectively. Further, the balance of deferred tax liabilities relating to land

revaluation decreased by ¥7,055 million ($58,792 thousand) and land revaluation in accu-

mulated other comprehensive income/(loss) increased by the same amount.

15 DERIVATIVE FINANCIAL INSTRUMENTS AND HEDGING

TRANSACTIONS

The Group uses forward foreign exchange contracts as derivative financial instruments

only for the purpose of mitigating future risks of fluctuations in foreign currency exchange

rates. Also, only for the purpose of mitigating future risks of fluctuations in interest rates

with respect to borrowings, the Group uses interest rate swap contracts. The Group does

not engage in speculative transactions as a matter of policy, limiting the transaction amount

to actual demand.

Forward foreign exchange contracts are subject to risks of foreign exchange rate

changes. Also, interest rate swap contracts are subject to risks of interest rate changes.

Use of derivatives to manage these risks could result in the risk of a counterparty

defaulting on a derivative contract. However, the Company believes that the risk of a coun-

terparty defaulting is minimum since the Group uses only highly credible financial institu-

tions as counterparties.

Mazda Annual Report 2015

56

C

CONTENTS

Growth Strategy

Message from Management

Introduction

Review of Operations

Foundations Underpinning

Sustainable Growth