Mazda 2015 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2015 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We also intend to address customer needs globally by

increasing flexibility in our production of sedans and SUVs to

maximize production capacity at our major production sites.

As we pursue these initiatives, global human resource

development will play a major role. We are working to cultivate

dependable human resources who are able to make good “big-

picture” judgments and take actions accordingly in areas

including development, production technologies, and quality

control. Our aim is to create an environment and structure in

which employees who understand and share the Mazda vision

are able to stand out and play a role at overseas production sites.

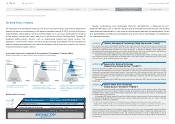

A strong financial base is essential for stable, continuous

growth. As we strengthen our financial base, we intend to raise

the dividend payout in stages. Although increasing equity will

have the effect of decreasing return on equity (ROE), we aim

to maintain ROE at a level of 13% to 15% during the period

covered by Structural Reform Stage 2. Supported by steady growth in sales volume, we will pursue

qualitative growth through increased business efficiency in

the areas of products, sales, production, and finance, as a

means of accelerating a significant increase in brand value. We

will implement these measures while strengthening the finan-

cial base, as we work to achieve the financial target set for the

March 2019 fiscal year.

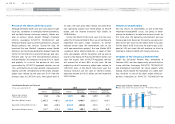

Reinforce Financial

Structure and

Shareholders Returns

50

500

1,000

201520142013 2017

(Forecast)

2018

(Forecast)

2019

(Forecast)

2016

(Forecast)

Equity / Equity Ratio

■ Equity (Billions of yen) (left scale) Equity Ratio (%) (right scale)

(200)

200

0

2017

(Forecast)

2018

(Forecast)

2019

(Forecast)

2016

(Forecast)

201520142013

Net Interest-bearing Debt / Free Cash Flow

■ Net Interest-bearing Debt*

1

(Billions of yen) Free Cash Flow*

2

(Billions of yen)

10

20

30

2

7

23 21

4

13

15

2017

(Forecast)

2018

(Forecast)

2019

(Forecast)

2016

(Forecast)

201520142013

Dividend Payout Ratio / ROE

Dividend Payout Ratio (%) ROE (%)

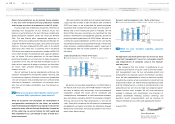

Full capacity

utilization at

overseas

production sites

Maintain domestic

capacity utilization

2012 2013 2019

(Forecast)

2016

(Forecast)

2014 2015

1.23 million

units

1.49 million

units

11%

increase

1.65 million

units

Global Production Volume

■ Domestic Production Volume ■ Overseas Production Volume

New plant in Mexico

Foreign exchange rate assumptions: ¥120 / USD, ¥130 / euro

*1. As of March 31 *2. Years ended March 31

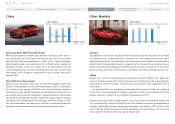

Structural Reform Stage 2

SPECIAL FEATURE

Global sales volume

1.397 million units 1.65 million units

Operating income ratio

6.7% 7% or more

Equity ratio

35.2% 45% or more

Dividend payout ratio

3.8% 20% or more

March 2019 Financial Target

Result for March 2015 fiscal year Target for March 2019 fiscal year

Mazda Annual Report 2015

13

Growth Strategy

(Years ended March 31)

(As of March 31)

(Years ended March 31)

CONTENTS

Foundations Underpinning

Sustainable Growth

Introduction

Review of Operations

Corporate Data

Message from Management