Mazda 2015 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2015 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In addition to continued strong sales of the CX-5 and the Mazda3 with

the launch of the new Mazda2, global sales volume was up 5.0% year

on year, at 1,397,000 units.

Net income amounted to ¥158.8 billion, an increase of 17.0% year on

year. ROE was at 20.8%.

Net sales amounted to ¥3,033.9 billion, an increase of 12.7% year on

year, owing to increased sales of SKYACTIV models in global markets.

Equity amounted to ¥869.6 billion, an increase of ¥208.9 billion from the end

of the prior fiscal year. The equity ratio increased 5.8 percentage points from

the end of the prior fiscal year, to 35.2%. (The percentage after consideration

of the equity credit attributes of the subordinated loan was 36.6%.)

Operating income amounted to ¥202.9 billion, an increase of 11.4%

year on year, owing to improvements in volume and product mix as well

as ongoing cost improvements through Monotsukuri Innovation.

Net interest-bearing debt decreased ¥91.1 billion, to ¥171.9 billion. The

net debt-to-equity ratio improved 20.0 percentage points, to 19.8%.

(The percentage after consideration of the equity credit attributes of

the subordinated loan was 15.1%.)

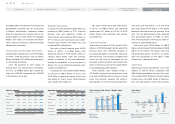

Financial Highlights

1,247

1,273 1,235 1,331 1,397

20122011 2013 2014 2015

31

51

74

(12.8)

(24.0)

(107.7)

(60.0)

34.3

7.1

23.5 20.8

135.7 158.8

20122011 2013 2014 2015

2,0 33.1

2,325.7 2,205.3

2,692.2

3,033.9

20122011 2013 2014 2015

24.5

24.2 25.1 29.4

35.2

468.9

428.8

496.3

660.7

869.6

20122011 2013 2014 2015

(1.9)

1.0 2.4

6.8 6.7

(38.7)

23.8

53.9

182.1 202.9

20122011 2013 2014 2015

64.2

86.3

55.2

39.8

19.8

300.8

370.2

274.1 263.0

171.9

20122011 2013 2014 2015

Global Sales Volume / SKYACTIV Ratio

■ Global Sales Volume (Thousands of units) SKYACTIV Ratio (%)

Net Income (Loss) / Return on Equity (ROE)

■ Net Income (Loss) (Billions of yen) ROE (%)

Net Sales

(Billions of yen)

Equity / Equity Ratio

■ Equity (Billions of yen) Equity Ratio (%)

Operating Income (Loss) / Operating Income Ratio

■ Operating Income (Loss) (Billions of yen) Operating Income Ratio (%)

Net Interest-bearing Debt / Net Debt-to-equity Ratio

■ Net Interest-bearing Debt (Billions of yen) Net Debt-to-equity Ratio (%)

(Years ended March 31)

(Years ended March 31)

(Years ended March 31)

(As of March 31)

(Years ended March 31)

(As of March 31)

Mazda Annual Report 2015

34

C

CONTENTS

Growth Strategy

Message from Management

Introduction

Review of Operations

Foundations Underpinning

Sustainable Growth