Mazda 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

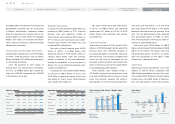

offset by the payment of income taxes and a

decrease in working capital from an increase

in inventories.

Investing activities used net cash in the

amount of ¥95.5 billion, compared with ¥120.1

billion used in the previous fi scal year. The

main component of this net outfl ow was

¥123.4 billion of outlays for the acquisition of

tangible fi xed assets, including capital invest-

ment for the new plant in Mexico and the new

transmission plant in Thailand.

As a result, consolidated free cash fl ow

was positive in the amount of ¥108.9 billion,

compared with a ¥16.3 billion positive free

cash fl ow in the previous fi scal year. The

Company was able to generate more than

¥100.0 billion of consolidated free cash fl ow

while maintaining a high level of capital in-

vestment for future growth.

Financing activities used net cash in the

amount of ¥62.8 billion, mainly from the

repayment of long-term loans payable, com-

pared with ¥10.5 billion generated in the

previous fi scal year.

Basic Dividend Policy, Dividends for

March 2015 and March 2016 Fiscal Years

Mazda’s basic policy regarding the stock

dividend is to determine the dividend by com-

prehensively taking into account factors

including fi nancial results for the fi scal year,

the business environment, and the Company’s

fi nancial position, while striving to maintain

stable shareholder returns with steady future

increases.

A dividend of ¥10 per share was paid for

the March 2015 fi scal year, and for the March

2016 fi scal year we intend to increase the

dividend by ¥20 per share, to a full-year divi-

dend of ¥30 per share, comprising an interim

dividend of ¥15 per share and a year-end divi-

dend of ¥15 per share.

Mazda intends to use internal reserves for

research and development and capital invest-

ment for future growth.

Forecast for March 2016 Fiscal Year

Although the global economy is expected to

show a gradual recovery, positioning ahead of

a review of U.S. monetary policy, economic

trends in emerging economies, and fl uctua-

tions in exchange rates and crude oil prices

represent elements of continued uncertainty

regarding the outlook for Mazda’s operating

environment. Against this backdrop, the

Company will continue to implement structural

reforms leveraging SKYACTIV TECHNOLOGY

and further enhance brand value in the March

2016 fi scal year, the fi nal year under the

Structural Reform Plan.

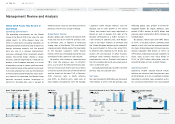

We are projecting a 6.6% increase in

global sales volume in the March 2016 fi scal

year, to 1,490,000 units. By market, we are

forecasting a 6.9% increase in Japan, to

240,000 units; a 5.6% increase in North

America, to 449,000 units; a 4.7% increase in

Europe, to 240,000 units; a 2.5% increase in

China, to 220,000 units; and a 12.3% increase

in other markets, to 341,000 units.

Our projections for consolidated fi nancial

results are for a 7.1% increase in net sales, to

¥3,250.0 billion; a 3.5% increase in operating

income, to ¥210.0 billion; and an 11.8% decline

in net income, to ¥140.0 billion. Our exchange

rate assumptions for the March 2016 fi scal

year are ¥120 to the U.S. dollar and ¥130 to

the euro.

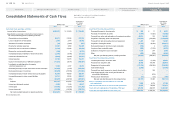

Forecast for the March 2016 Fiscal Year

(Billions of yen)

(Years ended

March 31) 2015 2016 (Forecast) Difference

Net sales 3,033.9 3,250.0 216.1

Operating

income 202.9 210.0 7.1

Net income 158.8 140.0 (18.8)

(Exchange

assumptions)

US$/Yen 110 120

€/Yen 139 130

Forecast for Global Sales Volume (Thousands of units)

(Years ended

March 31) 2015 2016 (Forecast) Difference

Japan 225 240 15

North

America 425 449 24

Europe 229 240 11

China 215 220 5

Other markets 303 341 38

Total 1,397 1,490 93

Mazda Annual Report 2015

38

C

CONTENTS

Growth Strategy

Message from Management

Introduction

Review of Operations

Foundations Underpinning

Sustainable Growth