Mazda 2015 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2015 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

New Mazda3 Axela (China specification) New Mazda2 (Thailand specification)

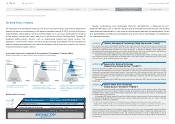

Sales Volume

Sales Volume (Thousands of units) Market Share (%)

Sales Volume

Sales Volume (Thousands of units) Market Share (%)

1.2

223

2012 2013 2014 2015 2016

175 196 215 220

0.9 0.9 0.9

(Forecast)

263

2012 2013 2014 2015 2016

300 293 303

341

(Forecast)

China Other Markets

Overview of March 2015 Fiscal Year Results

Reflecting an economic slowdown, total demand in China was lower than ini-

tially anticipated, with a 6% increase from the previous year, to 23.72 million

units. Despite intensified competition as a result of this sluggish automobile

market growth, Mazda’s sales volume grew 9%, to 215,000 units. In addition to

continued firm sales of the CX-5, strong sales of the new Mazda3 Axela and

the new Mazda6 Atenza, for which local production and sales started in May

2014, Mazda’s sales resulted in record monthly sales in October 2014 and in

February 2015.

March 2016 Fiscal Year Forecast

Mazda intends to maintain strong sales of SKYACTIV-equipped vehicles with

launches of the updated CX-5 and new Mazda6 Atenza, and it is projecting a

3% increase in sales volume, to 220,000 units. We will continue to build and

strengthen our sales network by opening new showrooms while also fortifying

our earnings bases at existing showrooms. In enhancing Mazda’s brand image,

we will continue to implement the third stage of the “primary brand” campaign

and aggressively promote SKYACTIV technology and KODO design. In addi-

tion, we will implement sales measures in such ways as using digital media for

targeted customers and proactively participating in local motor shows.

Australia

Total demand in Australia was roughly flat with the previous year, declining 0.5%, to 1.12 million

units. While our sales volume declined 3%, to 101,000 units, we maintained the previous year’s

high market share of 9% and a strong No. 3 position in terms of sales volume by manufacturer. In

addition, the CX-5 maintained the lead in its segment for the full year. We are aiming to raise our

market share by one percentage point in the March 2016 fiscal year, acquiring 10% of the market,

backed by solid sales of the CX-5 and full-year contributions from the new Mazda2 and new CX-3.

ASEAN

Mazda’s sales volume in the ASEAN market increased 3% overall, to 76,000 units. While sales

volume in Thailand was down 19% from the previous year, to 34,000 units, due to lower demand,

sales volume in Vietnam rose 126%, to 12,000 units, and in Malaysia sales volume grew 27%, to

12,000 units.

For the March 2016 fiscal year, Mazda is projecting a 19% increase in ASEAN sales volume, to

91,000 units. In the main market of Thailand, we will work to achieve a turnaround with the new

Mazda2, launched in January 2015, in addition to the Mazda3 and CX-5.

Mazda’s overall sales volume in other markets, including Australia and the ASEAN market, rose

3% in the March 2015 fiscal year, to 303,000 units. Sales volumes in countries including Malaysia,

Vietnam, Saudi Arabia, and New Zealand were the highest since the year 2000. With full-scale

sales of the new Mazda2 produced in Thailand and Mexico, we are projecting a 12% increase in

sales volume for the March 2016 fiscal year, to 341,000 units.

(Years ended

March 31)

(Years ended

March 31)

Mazda Annual Report 2015

17

Review of Operations

Growth Strategy

Message from Management

Foundations Underpinning

Sustainable Growth

Corporate Data

Introduction

CONTENTS