Mazda 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

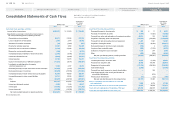

Fair values of financial instruments

As of March 31, 2015 and 2014, the carrying values on the consolidated balance sheet,

the fair values, and the differences between these amounts, respectively, of financial

instruments were as follows. Financial instruments for which fair value is deemed highly

difficult to measure are excluded from the following table.

Millions of yen Thousands of U.S. dollars

As of March 31, 2015

Carrying

values Fair values Difference

Carrying

values Fair values Difference

Assets:

1) Trade notes and

accounts receivable ¥ 215,161 $ 1,793,008

Allowance for

doubtful receivables (*1) (101) (842)

Trade notes and accounts

receivable, net 215,060 ¥ 215,060 ¥ — 1,792,166 $ 1,792,166 $ —

2) Investment securities

Available-for-sale securities 12,760 12,760 — 106,333 106,333 —

3) Long-term loans receivable (*2) 6,390 53,250

Allowance for

doubtful receivables (*3) (2,452) (20,433)

Long-term loans receivable, net 3,938 3,938 — 32,817 32,817 —

Total ¥ 231,758 ¥ 231,758 ¥ — $ 1,931,316 $ 1,931,316 $ —

Liabilities:

1) Trade notes and accounts payable ¥ 379,358 ¥ 379,358 ¥ — $ 3,161,317 $ 3,161,317 $ —

2) Other accounts payable 41,019 41,019 — 341,825 341,825 —

3) Short-term debt 116,677 116,677 — 972,308 972,308 —

4) Long-term debt 584,342 599,374 15,032 4,869,517 4,994,784 125,267

Total ¥ 1,121,396 ¥ 1,136,428 ¥ 15,032 $ 9,344,967 $ 9,470,234 $ 125,267

Derivative instruments: (*4)

1) Hedge accounting not applied ¥ 269 ¥ 269 ¥ — $ 2,242 $ 2,242 $ —

2) Hedge accounting applied 1,014 1,014 — 8,450 8,450 —

Total ¥ 1,283 ¥ 1,283 ¥ — $ 10,692 $ 10,692 $ —

Millions of yen

As of March 31, 2014 Carrying values Fair values Difference

Assets:

1) Trade notes and accounts receivable

¥ 180,544

Allowance for doubtful receivables (*1)

(175)

Trade notes and accounts receivable, net

180,369 ¥ 180,369 ¥ —

2) Investment securities

Available-for-sale securities

9,141 9,141 —

3) Long-term loans receivable (*2)

6,829

Allowance for doubtful receivables (*3)

(2,509)

Long-term loans receivable, net

4,320 4,320 —

Total

¥ 193,830 ¥ 193,830 ¥ —

Liabilities:

1) Trade notes and accounts payable

¥ 331,678 ¥ 331,678 ¥ —

2) Other accounts payable

38,469 38,469 —

3) Short-term debt

105,283 105,283 —

4) Long-term debt

637,452 654,766 17,314

Total

¥ 1,112,882 ¥ 1,130,196 ¥17,314

Derivative instruments: (*4)

1) Hedge accounting not applied

¥ (1,046) ¥ (1,046) ¥ —

2) Hedge accounting applied

(1,903) (1,903) —

Total

¥ (2,949) ¥ (2,949) ¥ —

(*1) Allowance for doubtful receivables, which is recognized on the basis of each individual accounts receivable, is deducted.

(*2) Long-term loans receivable include those due within one year, which are included in “other current assets” on the

consolidated balance sheets.

(*3) Allowance for doubtful receivables, which is recognized on the basis of each individual long-term loans receivable, is deducted.

(*4) Receivables and payables resulting from derivative transactions are offset against each other and presented on a net

basis; when a net liability results, the net amount is shown in ( ).

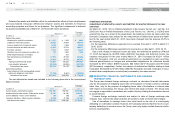

The financial instruments in the following table are excluded from “Assets 2) Investment

securities” in the above tables because measuring the fair value of these instruments is

deemed highly difficult: market prices of these instruments are not available and future

cash flows from these instruments are not contracted.

Millions of yen

Thousands of

U.S. dollars

Carrying values Carrying values

As of March 31 2015 2014 2015

Available-for-sale securities:

Non-listed equity securities ¥ 2,488

¥ 2,321

$ 20,734

Investment securities of affiliated companies 118,977

136,890

991,475

Total ¥121,465

¥139,211

$1,012,209

Mazda Annual Report 2015

50

C

CONTENTS

Growth Strategy

Message from Management

Introduction

Review of Operations

Foundations Underpinning

Sustainable Growth