Mazda 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

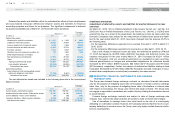

4 FINANCIAL INSTRUMENTS

Qualitative information on financial instruments

Policies for using financial instruments

The Group finances cash mainly through bank loans and the issuance of bonds, in light of

planned capital investment. Temporary surplus funds are managed through investments in

low-risk assets. Short-term operating funds are financed mainly through bank loans and

commercial paper. Our policies on derivative instruments are to use them to hedge risks,

as discussed below, and not to conduct speculative transactions.

Details of financial instruments and the exposures to risk

Trade notes and accounts receivable, while mostly due within one year, are subject to cus-

tomers’ credit risks. Accounts receivable denominated in foreign currencies are subject to

the risk of fluctuations in foreign currency exchange rates; such risk is hedged, in principle,

by netting the foreign-currency-denominated accounts receivable against accounts pay-

able, and applying foreign exchange forward contracts on the resulting net position.

Investment securities consist mainly of stocks of our business partner companies and

are subject to the risk of market price fluctuations and other factors. Long-term loans

receivable are provided mainly to our business partner companies.

Trade notes and accounts payable, as well as other accounts payable, are due within

one year. Of these payables, those denominated in foreign currencies are subject to the

risk of fluctuations in foreign exchange rates. However, the balance of such payables

denominated in major currencies is constantly less than that of the accounts receivable

denominated in the same foreign currency. For minor currencies where this does not apply,

such payables are hedged, as necessary, through foreign exchange forward contracts,

considering the transaction amounts and the degree of risk of foreign exchange rate

fluctuation.

Loans payable, bonds payable, and finance lease obligations are mainly intended for

financing cash required for capital investment. The longest time to maturity of these liabili-

ties is 57 years and 4 months from March 31, 2015. Of these liabilities, those of the vari-

able-interest-rate type are subject to the risk of interest rate fluctuations; part of them is

hedged through derivative transactions (interest rate swaps).

Derivative instruments consist of foreign exchange forward contracts and interest rate

swaps. For details on derivative instruments, refer to “Derivatives and hedge accounting”

under Note 2, “Significant Accounting Policies,” and Note 15, “Derivative Financial

Instruments and Hedging Transactions”.

Policies and processes for managing the risk

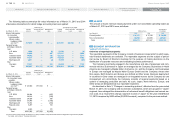

Management of credit risks (i.e., risks associated to the default of counterparties)

The Group manages credit risks, in compliance with internal control rules and procedures.

The due dates and the balances of trade notes, accounts receivable, and loans receiv-

able from major counterparties are monitored and managed, in order to detect early and

mitigate the risk of doubtful receivables.

Derivative transactions are executed only with banks with high credit ratings, in order to

mitigate counterparty risk.

For derivatives, the credit risks of counterparty financial institutions are reviewed on a

quarterly basis.

The amount of maximum risk as of March 31, 2015 is represented by the balance sheet

amount of financial assets exposed to credit risks.

Management of market risks (i.e., risks associated to fluctuations in foreign exchange

rates and interest rates)

The Company and some of its consolidated subsidiaries hedge the risk of foreign

exchange rate fluctuation on foreign-currency-denominated receivables and payables,

using foreign exchange forward contracts, on a monthly and individual currency basis.

Foreign exchange forward contracts are executed as necessary, up to six months ahead at

longest, on foreign-currency-denominated receivables and payables that are expected to

arise with certainty as a result of forecasted export and import transactions.

The Company and some of its consolidated subsidiaries use interest rate swaps in

order to reduce the risk of interest rate fluctuation on loans payable.

For details on management of derivative transactions, refer to Note 15, “Derivative

Financial Instruments and Hedging Transactions”.

As regards investment securities, their fair values as well as the financial standing of

their issuing entities are monitored on a regular basis. Ownership of available-for-sale

securities are reviewed on a continuous basis.

Management of liquidity risks related to financing (i.e., risks of non-performance of

payments on their due dates)

The liquidity risks of the Group are managed mainly through the preparation and update of

the cash schedule by the Treasury Department.

Mazda Annual Report 2015

49

C

CONTENTS

Growth Strategy

Message from Management

Introduction

Review of Operations

Foundations Underpinning

Sustainable Growth