Mazda 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

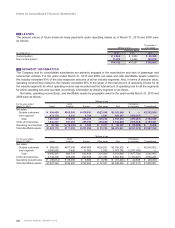

(Additional Information)

Commencing in the year ended March 31, 2009, the Company and its consolidated subsidiaries adopted ASBJ

Statement No. 11, Accounting Standard for Related Party Disclosures, and its Implementation Guidance—ASBJ

Guidance No. 13, Guidance on Accounting Standard for Related Party Disclosures—both issued on October 17, 2006.

Prior to the year ended March 31, 2009, only those transactions between the Company and its related parties were

considered for disclosure as material related party transactions. Commencing in the year ended March 31, 2009, as a

result of adopting these new standards, in addition to the transactions considered for disclosure in the prior years,

those transactions between the Company’s consolidated subsidiaries and the Company’s related parties are also

considered for disclosure as material related party transactions.

During the years ended March 31, 2010 and 2009, the Company’s consolidated foreign subsidiary in the United

States recognized, based on the applicable U.S. GAAP, lease obligations for certain tooling and other assets used in

production that are owned by AutoAlliance International, Inc. (“AAI”), an affiliate which is accounted for by the equity

method by the Company. For the year ended March 31, 2010, capital lease transactions amounted to ¥4,583 million

($49,280 thousand) while repayments of lease obligations and interest on lease obligations amounted to ¥4,510 million

($48,495 thousand) and ¥1,558 million ($16,753 thousand), respectively, and the ending balance of lease obligations

was ¥25,827 million ($277,710 thousand). Also, for the year ended March 31, 2009, capital lease transactions

amounted to ¥32,069 million, and the ending balance of lease obligations was ¥27,187 million. The actual payments of

lease obligations are made through the Company.

During the year ended March 31, 2009, the Company purchased treasury stock from Ford Motor Company (“Ford”).

Prior to November 19, 2008, Ford had owned one-third of the Company’s voting interest, and the Company had been

an (equity method-applied) affiliate of Ford. On November 19, 2008, Ford sold part of its shares of the Company’s

common stock, and of the total shares sold by Ford, the Company purchased 96,802,000 shares at ¥184 per share, or

a total amount of ¥17,812 million, through ToSTNeT-3 Off-Hour Trading System of the Tokyo Stock Exchange. As a

result, the Company is no longer an (equity method-applied) affiliate of Ford. However, Ford still remains a major

shareholder of and, as such, a related party to the Company. As of March 31, 2009, Ford had a 14.9% voting interest

of the Company.

During the year ended March 31, 2009, the Company’s consolidated foreign subsidiaries in Europe liquidated their

receivables with FCE Bank plc. (“FCE”), a subsidiary in Europe of Ford. The total amount of transactions during the

year was ¥393,490 million. To the extent the transactions are subject to the guarantee extended to FCE by the

Company’s subsidiaries, the amount received is accounted for as a financial liability and reported as short-term debt

in the consolidated balance sheet; otherwise, the transactions are accounted for as sale of receivables. The balance

of short-term debt in the consolidated balance sheet as of March 31, 2009 was ¥5,472 million.

Assets and liabilities related to finance lease transactions that were newly recognized in the year ended March 31,

2009 amounted to ¥34,291 million and ¥34,400 million, respectively.

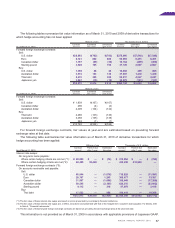

The following appropriation of retained earnings was approved at a shareholders’ meeting held on June 24, 2010:

Thousands of

Millions of yen U.S. dollars

Year-end cash dividends: ¥3.00 ($0.03) per share ¥5,311 $57,108