Mazda 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

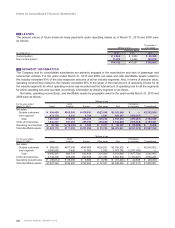

59

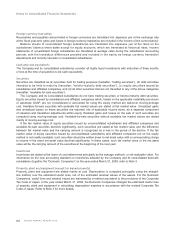

Loans payable, bonds payable, and finance lease obligations are mainly intended for financing cash required for

capital investment. The longest time to maturity of these liabilities is 29 years and 3 months. Of these liabilities, those

of the variable-interest-rate type are subject to the risk of interest rate fluctuations; part of them is hedged through

derivative transactions (interest rate swaps).

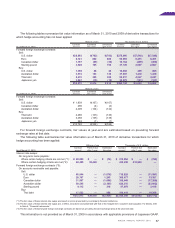

Derivative instruments consist of foreign exchange forward contracts and interest rate swaps. For details on

derivative instruments, refer to “Derivatives and hedge accounting” under Note 2, “Significant Accounting Policies,”

and Note 15, “Derivative Financial Instruments and Hedging Transactions.”

Policies and processes for managing the risk

Management of credit risks (i.e., risks associated to the default of counterparties)

The Company and its consolidated subsidiaries manage credit risks, in compliance with internal control rules and

procedures.

The due dates and the balances of trade notes, accounts receivable, and loans receivable from major

counterparties are monitored and managed, in order to detect early and mitigate the risk of doubtful receivables.

Short-term investments are limited mainly to time deposits and certificates of deposit of banks approved by our

finance officer. As such, the credit risks of these short-term investments are considered to be minimal.

Derivative transactions are executed only with banks with high credit ratings, in order to mitigate counterparty risk.

For both short-term investments and derivatives, the credit risks of counterparty financial institutions are reviewed

on a quarterly basis.

Management of market risks (i.e., risks associated to fluctuations in foreign exchange rates and interest rates)

The Company and some of its consolidated subsidiaries hedge the risk of foreign exchange rate fluctuation on

foreign-currency-denominated receivables and payables, using foreign exchange forward contracts, on a monthly and

individual currency basis. Foreign exchange forward contracts are executed as necessary, up to six months ahead

at longest, on foreign-currency-denominated receivables and payables that are expected to arise with certainty as a

result of forecasted export and import transactions.

The Company and some of its consolidated subsidiaries use interest rate swaps in order to reduce the risk of

interest rate fluctuation on loans payable.

For details on management of derivative transactions, refer to Note 15, “Derivative Financial Instruments and

Hedging Transactions.”

As regards short-term investments and investment securities, their fair values as well as the financial standing of

their issuing entities are monitored on a regular basis. Ownership of available-for-sale securities are reviewed on a

continuous basis.

Management of liquidity risks related to financing (i.e., risks of non-performance of payments on their due dates)

The liquidity risks of the Company and its consolidated subsidiaries are managed mainly through the preparation and

update of the cash schedule by the Treasury Department.

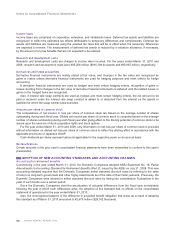

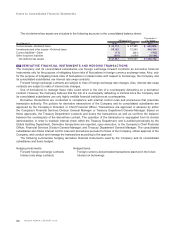

Fair values of financial instruments

As of March 31, 2010, the carrying values on the consolidated balance sheet, the fair values, and the differences

between these amounts, respectively, of financial instruments were as follows. Financial instruments whose fair value

is deemed highly difficult to measure are excluded from the following table.