Mazda 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

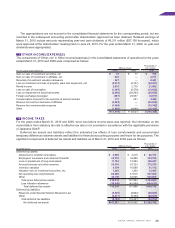

58

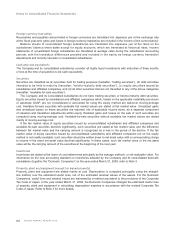

Change in accounting for materials sold to and purchased back from suppliers after fabrication

Prior to the year ended March 31, 2009, in the consolidated statements of operations, the Company accounted for

materials sold to suppliers for the purpose of purchasing back from them after fabrication in such a manner that the

transactions were recognized in both net sales and cost of sales, as the Company was emphasizing the contractual

condition that the ownership title to the materials transfers through the transactions. Commencing in the year ended

March 31, 2009, the Company changed accounting for these transactions to exclude the amounts from both net

sales and cost of sales, as the Company now emphasizes the substance of the transactions that the materials are

purchased back after fabrication.

The effects of this accounting change on the consolidated statement of operations for the year ended March 31,

2009 were to decrease net sales and cost of sales each by ¥152,097 million with no effects on operating loss and loss

before income taxes.

Also, the effects of this accounting change on segment information are discussed in the applicable section of the

notes to the consolidated financial statements.

Additional Information

Change in estimated useful lives of property, plant and equipment

As the Corporate Tax Code of Japan was revised on April 30, 2008 to implement certain changes to useful lives of

property, plant and equipment, commencing in the year ended March 31, 2009, the Domestic Companies changed

the estimated useful lives of property, plant and equipment in calculating depreciation expense in accordance with the

revised Corporate Tax Code of Japan.

The effects of this change on the consolidated statement of operations for the year ended March 31, 2009 were to

increase operating loss by ¥2,325 million and to increase loss before income taxes by ¥2,337 million.

The effects of this change on the segment information are discussed in the applicable section of the notes to the

consolidated financial statements.

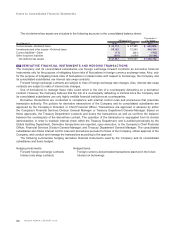

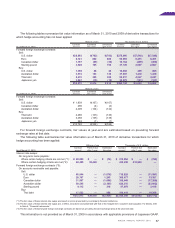

(Additional Information)

Commencing in the year ended March 31, 2010, the Domestic Companies adopted the revised ASBJ Statement

No. 10, Accounting Standard for Financial Instruments, and its Implementation Guidance—ASBJ Guidance No. 19,

Guidance on Disclosures about Fair Value of Financial Instruments, both issued on March 10, 2008.

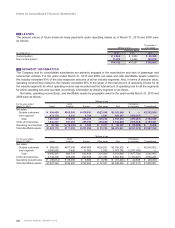

Qualitative information on financial instruments

Policies for using financial instruments

The Company and its consolidated subsidiaries finance cash mainly through bank loans and the issuance of bonds,

in light of planned capital investment. Temporary surplus funds are managed through investments in low-risk assets.

Short-term operating funds are financed mainly through bank loans and commercial paper. Our policies on derivative

instruments are to use them to hedge risks, as discussed below, and not to conduct speculative transactions.

Details of financial instruments and the exposures to risk

Trade notes and accounts receivable, while mostly due within one year, are subject to customers’ credit risks.

Accounts receivable denominated in foreign currencies are subject to the risk of fluctuations in foreign currency

exchange rates; such risk is hedged, in principle, by netting the foreign-currency-denominated- accounts receivable

against accounts payable, and applying foreign exchange forward contracts on the resulting net position.

Short-term investments consist mainly of certificate of deposits and other highly-liquid short-term investments.

Investment securities consist mainly of stocks of our business partner companies and are subject to the risk of market

price fluctuations and other factors. Long-term loans are provided mainly to our business partner companies.

Trade notes and accounts payable, as well as other accounts payable, are due within one year. Of these payables,

those denominated in foreign currencies are subject to the risk of fluctuations in foreign exchange rates. However,

the balance of such payables denominated in major currencies is constantly less than that of the accounts receivable

denominated in the same foreign currency. For minor currencies where this does not apply, such payables are

hedged, as necessary, through foreign exchange forward contracts, considering the transaction amounts and the

degree of risk of foreign exchange rate fluctuation.