Mazda 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

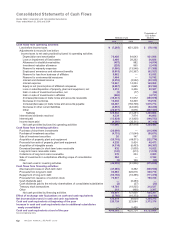

(Cash Flow from Financing Activities)

Financing activities generated net cash in the amount of

¥61.0 billion, primarily from funds procured via long-term

borrowings, the issuance of new shares, and the re-

issuance of treasury stock shares.

Free cash flow—the sum of cash flows from operating

and investing activities—was positive in the amount of

¥67.4 billion for the year.

Fund procurement during the year consisted of ¥78.4

billion in long-term borrowing and ¥93.3 billion from the

capital increase carried out in October and November, 2009.

Mazda formed a global partnership with the Ford Motor

Company in 1979, and since then both companies have

further developed and strengthened their cooperative rela-

tionship. An agreement was concluded in 1996 to further

bolster that relationship with an increase in Ford’s equity in

Mazda’s total shares outstanding to 33.4%. On November

19, 2008, Ford sold a portion of its shareholding, reducing

its stake in Mazda to 13.8%. Subsequently, Mazda carried

out a capital increase via public offering in October 2009,

and a capital increase via third-party allotment in November

2009, which reduced Ford’s shareholding to 11.0% of

Mazda’s total shares outstanding. Nevertheless, there has

been no change in the strategic relationship between the

two companies; Ford remains Mazda’s largest shareholder

and the two companies continue to operate joint businesses

and use common platforms and powertrains.

Our consolidated financial forecasts for the March 2011

fiscal year are shown below. In addition to the expectation

that a full-fledged recovery in automotive demand will

require some more time, we are anticipating a continued

strong yen and higher prices for materials. Against this

backdrop, we will strive to reinforce sales while at the same

time aim for profitability in all profit categories, by steadily

working to improve earnings in order to create a more

robust cost structure. Our exchange rate assumptions for

the year are ¥90/U.S. dollar and¥125/euro.

• Global sales volume: 1.27 million units (a 6% increase

from the March 2010 fiscal year)

• Net sales: ¥2,270.0 billion (5% increase)

• Operating income: ¥30.0 billion (217% increase)

• Net income: ¥5.0 billion

(March 2011 fiscal year outlook was released as of April 27, 2010.)

33.6

(81.0)

21.0

(95.4)

10.2

114.6 116.4 103.0

(92.8)

(67.4)(61.8)

(129.2)

111.6

67.4

(44.3)

Cash flow from investing activities (Billions of yen)

Free cash flow (Billions of yen)

Cash flow from operating activities (Billions of yen)

)''- )''. )''/ )''0 )'('

(Years ended March 31)

:Xj_]cfnj

45