Mazda 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

production, resulting in an impairment loss of ¥372 million ($4,000 thousand) and ¥23,678 million, respectively, in the

consolidated statement of operations. As a result, the total impairment loss that was recognized in the consolidated

statement of operations for the years ended March 31, 2010 and 2009 amounted to ¥2,495 million ($26,828

thousand) and ¥28,262 million, respectively.

Short-term debt as of March 31, 2010 and 2009 consisted of loans, principally from banks with interest averaging

1.26% and 1.50% for the respective years.

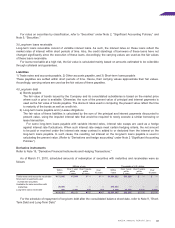

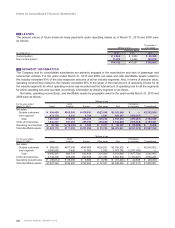

Long-term debt as of March 31, 2010 and 2009 consisted of the following:

Thousands of

Millions of yen U.S. dollars

As of March 31 2010 2009 2010

Domestic unsecured bonds due serially 2009 through 2016

at rates of 0.56% to 1.87% per annum ¥ 95,950(a) ¥ 95,000 $1,031,721

Loans principally from banks:

Secured loans, maturing through 2020 67,870 66,433 729,785

Unsecured loans, maturing through 2018 431,587 407,479 4,640,720

Lease obligations, maturing through 2039 45,885 57,224 493,387

641,292 626,136 6,895,613

Amount due within one year (85,009) (61,613) (914,075)

¥556,283 ¥564,523 $5,981,538

(a) As of March 31, 2010, certain of these unsecured bonds amounting to ¥950 million ($10,215 thousand) are bank-guaranteed under the condition that assets

are pledged to the bank as collateral by the issuer of the bonds.

The annual interest rates applicable to long-term loans and lease obligations outstanding averaged 1.50% and

2.80%, respectively, for obligations due within one year and 1.70% and 3.24%, respectively, for obligations due after

one year at March 31, 2010.

The annual interest rates applicable to long-term loans and lease obligations outstanding averaged 1.68% and

3.76%, respectively, for obligations due within one year and 1.86% and 4.39%, respectively, for obligations due after

one year at March 31, 2009.

As is customary in Japan, general agreements with banks include provisions that security and guarantees will be

provided if requested by banks. Banks have the right to offset cash deposited with them against any debt or obligation

that becomes due and, in the case of default or certain other specified events, against all debts payable to banks.

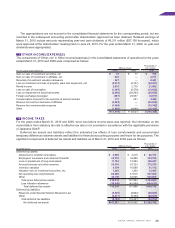

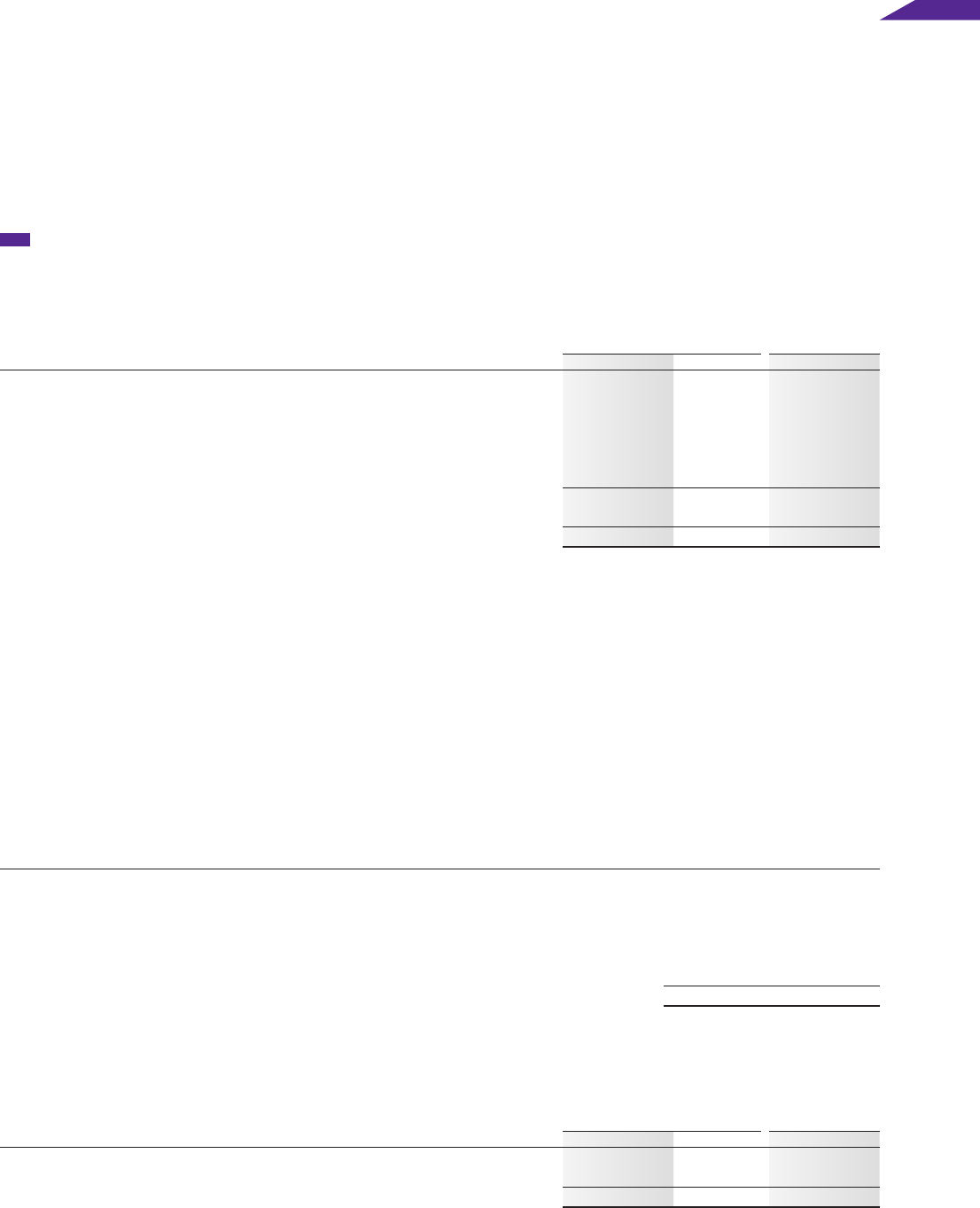

The annual maturities of long-term debt at March 31, 2010 were as follows:

Thousands of

Year ending March 31 Millions of yen U.S. dollars

2011 ¥ 85,009 $ 914,075

2012 173,416 1,864,688

2013 90,311 971,086

2014 95,268 1,024,387

2015 76,280 820,215

Thereafter 121,008 1,301,162

¥641,292 $6,895,613

The assets pledged as collateral for short-term debt of ¥34,389 million ($369,774 thousand) and ¥53,690 million

and long-term debt of ¥68,820 million ($740,000 thousand) and ¥66,433 million at March 31, 2010 and 2009,

respectively, were as follows:

Thousands of

Millions of yen U.S. dollars

As of March 31 2010 2009 2010

Property, plant and equipment, at net book value ¥431,020 ¥458,911 $4,634,624

Other 33 5,079 354

¥431,053 ¥463,990 $4,634,978