Mazda 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

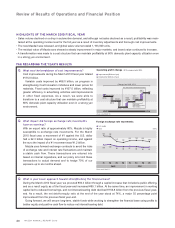

Q. What impact did foreign exchange rate movements

have on earnings?

With an export ratio of approximately 80%, Mazda is highly

susceptible to exchange rate movements. For the March

2010 fiscal year, a movement of ¥1 against the U.S. dollar

had a ¥2.3 billion impact on operating income, and against

the euro the impact of a ¥1 movement was ¥1.2 billion.

Mazda uses forward exchange contracts to avoid the risks

of exchange rate and interest rate fluctuations and maintain

a stable cash flow. These transactions are entered into

based on internal regulations, and our policy is to limit these

transactions to actual demand and to hedge 70% of our

exposure up to six months ahead.

• Sales volume declined on a drop in automotive demand, and although net sales declined as a result, profitability was main-

tained at the operating income level for the full year as a result of inventory adjustments and thorough cost improvements.

• The new Mazda3 was released, and global sales volume totaled 1,193,000 units.

• The residual value of Mazda cars showed a steady improvement in major markets, and brand value continued to increase.

• A transformation was made to a cost structure that can maintain profitability at 80% domestic plant capacity utilization even

in a strong yen environment.

(28.4) +68.0

+22.7

+84.3 9.5

(60.6)

(76.5)

)''0 )'('

(Years ended March 31)

Improvement (Billions of yen)

Deterioration (Billions of yen)

2010 compared with 2009

Change from 2009 +37.8

Volume & Mix

Foreign

Exchange Variable

Costs

Cost improvement totaled ¥175.0 billion

Fixed costs

improvement totaled

¥107.0 billion

Marketing

Expenses

Others

Fg\iXk`e^gif]`kZ_Xe^\

Q. What was the breakdown of cost improvements?

Cost improvements during the March 2010 fiscal year totaled

¥175.0 billion.

Variable costs improved by ¥68.0 billion, on progress in

strengthening Cost Innovation initiatives and lower prices for

materials. Fixed costs improved by ¥107.0 billion, reflecting

greater efficiency in advertising activities and improvements

in other fixed expenses. As a result, we were able to

transform to a cost structure that can maintain profitability at

80% domestic plant capacity utilization even in a strong yen

environment.

163

105

162

108

127

96

122

94

133

97

134

94

133

90

126

91

U.S. dollar

Euro (Yen)

)''0 )'('

(H )H *H +H (H )H *H +H

(Years ended March 31)

=fi\`^e\oZ_Xe^\iXk\dfm\d\ekj

Q. What is your basic approach toward strengthening the financial base?

During the March 2010 fiscal year, we procured ¥93.3 billion through a capital increase that included a public offering,

and as a result equity as of the fiscal year-end increased ¥95.1 billion. At the same time, an improvement in working

capital led to reduced borrowings, and net interest-bearing debt declined ¥156.8 billion from the previous fiscal year-

end. As a result, the net debt-to-equity ratio at the end of the year stood at 74%, a major 55 percentage point

improvement from the previous fiscal year-end.

Going forward, we will secure long-term, stable funds while working to strengthen the financial base using profits to

bolster equity and positive cash flow to reduce net interest-bearing debt.

40