Mazda 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

The appropriations are not accrued in the consolidated financial statements for the corresponding period, but are

recorded in the subsequent accounting period after shareholders’ approval has been obtained. Retained earnings at

March 31, 2010 include amounts representing year-end cash dividends of ¥5,311 million ($57,108 thousand), which

were approved at the shareholders’ meeting held on June 24, 2010. For the year ended March 31, 2009, no year-end

dividends were appropriated.

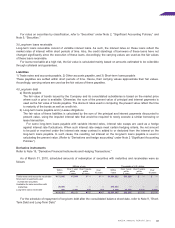

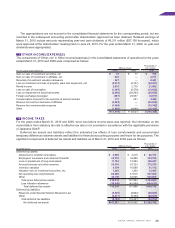

The components of “Other, net” in Other income/(expenses) in the consolidated statements of operations for the years

ended March 31, 2010 and 2009 were comprised as follows:

Thousands of

Millions of yen U.S. dollars

For the years ended March 31 2010 2009 2010

Gain on sale of investment securities, net ¥ 10 ¥ 77 $ 108

Gain on sale of investment in affiliates, net 440 — 4,731

Reversal of investment valuation allowance 227 — 2,441

Loss on retirement and sale of property, plant and equipment, net (3,012) (2,707) (32,387)

Rental income 2,035 2,179 21,882

Loss on sale of receivables (1,397) (5,376) (15,022)

Loss on impairment of long-lived assets (2,495) (28,262) (26,828)

Foreign exchange (loss)/gain (807) 29,057 (8,677)

Compensation received for the exercise of eminent domain 311 251 3,344

Reserve for loss from business of affiliates (5,862) — (63,032)

Reserve for environmental measures (1,464) — (15,742)

Other (1,505) (4,840) (16,184)

¥(13,519) ¥ (9,621) $(145,366)

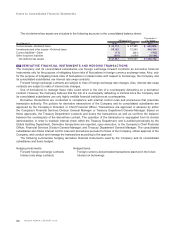

For the years ended March 31, 2010 and 2009, since loss before income taxes was reported, the information on the

reconciliation from statutory tax rate to effective tax rate is not provided in accordance with the applicable provisions

of Japanese GAAP.

Deferred tax assets and liabilities reflect the estimated tax effects of loss carryforwards and accumulated

temporary differences between assets and liabilities for financial accounting purposes and those for tax purposes. The

significant components of deferred tax assets and liabilities as of March 31, 2010 and 2009 were as follows:

Thousands of

Millions of yen U.S. dollars

As of March 31 2010 2009 2010

Deferred tax assets:

Allowance for doubtful receivables ¥ 2,060 ¥ 2,219 $ 22,151

Employees’ severance and retirement benefits 32,970 34,989 354,516

Loss on impairment of long-lived assets 11,183 12,982 120,247

Accrued bonuses and other reserves 25,316 25,723 272,215

Inventory valuation 4,759 10,089 51,172

Valuation loss on investment securities, etc. 1,202 1,202 12,925

Net operating loss carryforwards 82,569 47,615 887,839

Other 56,159 63,065 603,860

Total gross deferred tax assets 216,218 197,884 2,324,925

Less valuation allowance (59,949) (45,888) (644,613)

Total deferred tax assets 156,269 151,996 1,680,312

Deferred tax liabilities:

Reserves under Special Taxation Measures Law (6,225) (6,662) (66,935)

Other (2,477) (5,769) (26,635)

Total deferred tax liabilities (8,702) (12,431) (93,570)

Net deferred tax assets ¥147,567 ¥139,565 $1,586,742