Mazda 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

Practical Solution on Unification of Accounting Policies Applied to Foreign Subsidiaries for Consolidated

Financial Statements

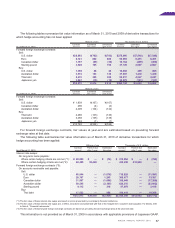

As discussed in Note 1, commencing in the year ended March 31, 2009, the Company and its consolidated foreign

subsidiaries adopted PITF No. 18, and made necessary adjustments in preparing the consolidated financial

statements.

In principle, Japanese GAAP requires that accounting policies and procedures applied by a parent company and its

consolidated subsidiaries, including consolidated foreign subsidiaries, be unified (in terms of Japanese GAAP) for the

purpose of preparing consolidated financial statements. However, prior to the year ended March 31, 2009, in preparing

the consolidated financial statements, as a tentative measure, for consolidated foreign subsidiaries, Japanese GAAP

allowed a parent company to use the financial statements of consolidated foreign subsidiaries prepared in conformity

with the generally accepted accounting principles prevailing in the respective countries of domicile, without reflecting

reconciling adjustments from accounting principles of various countries to Japanese GAAP.

PITF No. 18, which became effective as of April 1, 2008, revised the tentative measure. Under the revised

tentative measure, PITF No. 18 allows a parent company to prepare consolidated financial statements, using

consolidated foreign subsidiaries’ financial statements which reflect adjustments to reconcile from the accounting

principles of the respective countries of domicile to either IFRS or U.S. GAAP as necessary.

In addition, adjustments for the following six items specified in PITF No. 18 from IFRS or U.S. GAAP to Japanese

GAAP should be made as necessary in the consolidation process unless the impact is immaterial:

(a) If the amortization of goodwill is not implemented, adjustments should be made to amortize it;

(b) If actuarial gains and losses of defined-benefit retirement plans are recognized outside profit and loss, adjustments

should be made to recognize them in the income statement;

(c) If expenditures for research and development activities are capitalized, adjustments should be made to

immediately expense them;

(d) If fair value measurement of investment properties is adopted or revaluation of property, plant and equipment and

intangible assets is adopted, adjustments should be made for recording the depreciation expense calculated by

applying the regular depreciation method;

(e) If retrospective treatment of a change in accounting policies is adopted, adjustments should be made to recognize

the amount as profit and loss in the current fiscal year; and

(f ) If minority interests are included in the current net income, adjustments should be made to exclude the minority

interests from net income.

As a transition requirement of PITF No. 18, the balance of consolidated retained earnings as of April 1, 2008 was

reduced by ¥1,554 million. Also, in the consolidated statement of operations for the year ended March 31, 2009, while

the effect of adopting PITF No. 18 on operating loss was immaterial, loss before income taxes was increased by

¥3,119 million.

Also, in connection with adopting PITF No. 18, incentive expenses of consolidated foreign subsidiaries that were

recognized in selling, general and administrative expenses in the prior periods are now recognized as a reduction to

net sales. For the year ended March 31, 2009, such incentive expenses amounted to ¥146,697 million, and the effects

of this change on the consolidated statement of operations for the year ended March 31, 2009 were to decrease net

sales, gross profit on sales, and selling, general and administrative expenses each by the same amount.

Also, the effects of adopting PITF No. 18 on segment information are discussed in the applicable section of the

notes to the consolidated financial statements.

Accounting standard for measurement of inventories

Commencing in the year ended March 31, 2009, the Domestic Companies adopted ASBJ Statement No. 9,

Accounting Standards for Measurement of Inventories, issued by the ASBJ on July 5, 2006. As permitted under the

superseded accounting standard, the Domestic Companies previously stated inventories at cost. The new accounting

standard requires that inventories held for sale in the ordinary course of business be measured at the lower of cost

or net realizable value, which is defined as selling price less estimated additional manufacturing costs and estimated

direct selling expenses.

The effects of adopting the new standard on the consolidated statement of operations for the year ended March

31, 2009 were to increase operating loss and loss before income taxes each by ¥2,461 million.

Also, the effects of adopting the new standard on segment information are discussed in the applicable section of

the notes to the consolidated financial statements.