Mazda 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

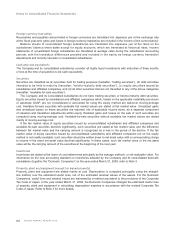

Intangible assets (except for leased property)

Intangible assets are amortized principally on the straight-line method over the estimated useful lives of the assets.

For the Domestic Companies, useful lives are estimated by a method equivalent to the provisions of the Corporate

Tax Code of Japan. Software for internal use is amortized on a straight-line basis over the period of internal use, i.e.,

5 years.

Leased property

Finance leases are capitalized in the balance sheet. Depreciation or amortization expense is recognized on a straight-

line basis over the lease period. For leases with a guaranteed minimum residual value, the contracted residual value

is considered to be the residual value for financial accounting purposes. For other leases, the residual value is zero.

Allowance for doubtful receivables

Allowance for doubtful receivables provides for the losses from bad debt. The amount estimated to be uncollectible is

recognized. For receivables of ordinary risk, the amount is estimated based on the past default ratio. For receivables

of high risk and receivables from debtors under bankruptcy proceedings, the amount is estimated based on the

financial standing of the debtor.

Investment valuation allowance

Investment valuation allowance provides for losses from investments. The amount is estimated in light of the financial

standing of the investee companies.

Reserve for warranty expenses

In order to match the recognition of after-sales expenses to product (vehicle) sales revenues, an amount estimated

based on product warranty provisions and actual costs incurred in the past, taking future prospects into consideration,

is recognized.

Employees’ severance and retirement benefits

The Domestic Companies provide various types of post-employment benefit plans, including lump-sum plans, defined

benefit pension plans, and defined contribution pension plans, under which all eligible employees are entitled to

benefits based on the level of wages and salaries at the time of retirement or termination, length of service, and

certain other factors. Also, consolidated foreign subsidiaries provide defined benefit and/or contribution plans.

The liabilities and expenses for severance and retirement benefits are determined based on the amounts

actuarially calculated using certain assumptions.

Employees’ severance and retirement benefits are provided based on the estimated amounts of projected benefit

obligation and the fair value of the plan assets. Prior service costs are recognized in expenses in equal amounts

mainly over 12 years, which is within the average of the estimated remaining service periods of employees, and

actuarial gains and losses are recognized in expenses using the straight-line basis mainly over 13 years, which is

within the average of the estimated remaining service periods, commencing with the following period.

Reserve for loss from business of affiliates

Reserve for loss from business of affiliates provides for losses from affiliates’ businesses. The amount of loss

estimated to be incurred by the Company is recognized.

Reserve for environmental measures

Reserve for environmental measures provides for expenditure aimed at environmental measures. The amount of

future expenditure estimated as of the end of the current fiscal year is recognized.

(Additional Information)

In the year ended March 31, 2010, the Domestic Companies accrued expense related to disposal of PCB

(polychlorinated biphenyl) waste for the estimated amount of future expenditure. The effect of this recognition on the

consolidated statement of operations for the year ended March 31, 2010 was to increase loss before income taxes by

¥1,464 million ($15,742 thousand).