Mazda 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

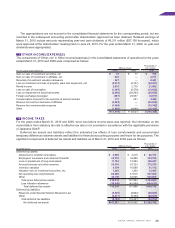

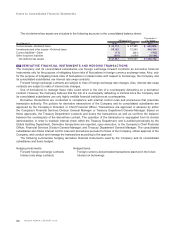

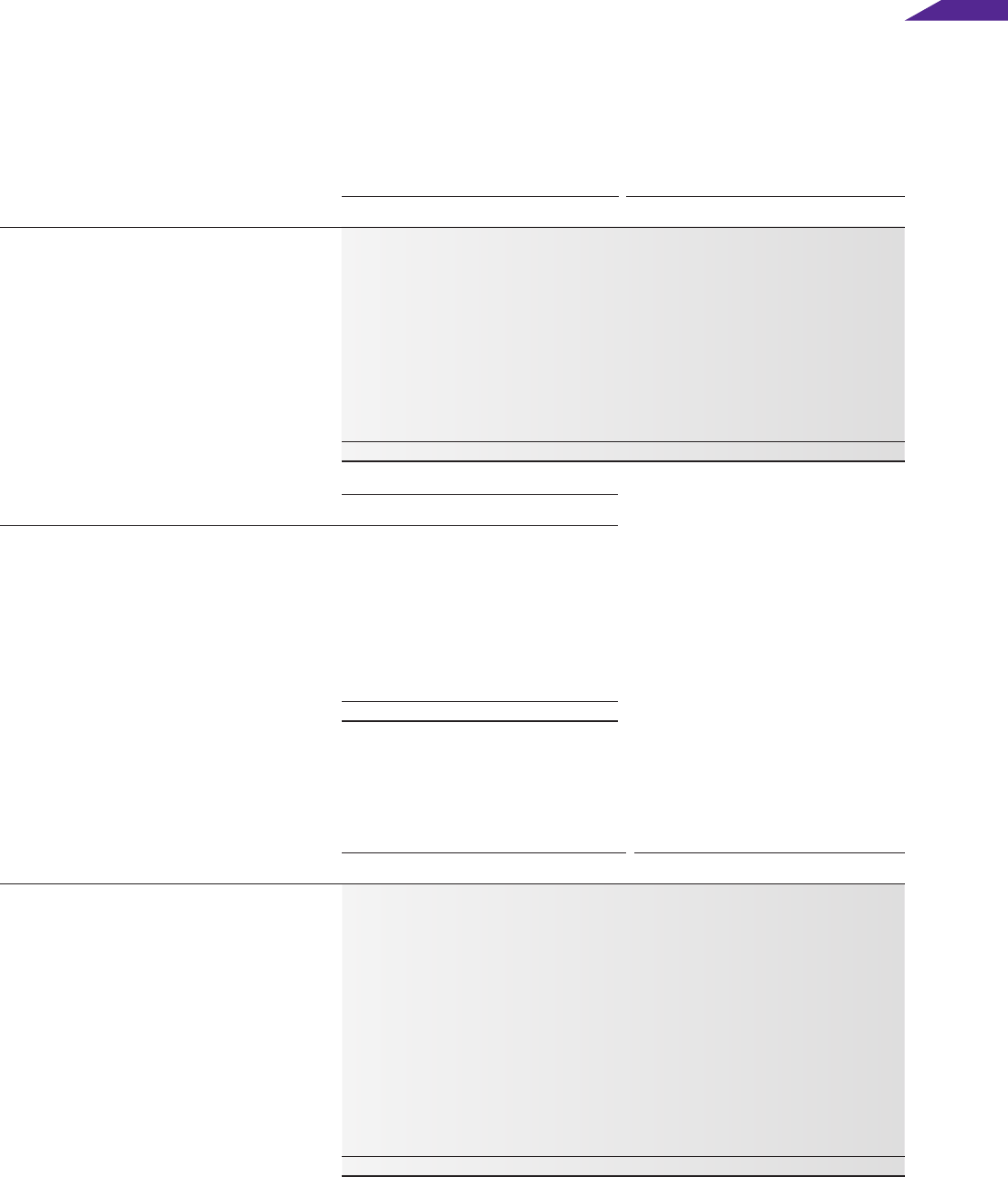

The following tables summarize fair value information as of March 31, 2010 and 2009 of derivative transactions for

which hedge accounting has not been applied:

Millions of yen Thousands of U.S. dollars

Contract Estimated Unrealized Contract Estimated Unrealized

As of March 31, 2010 amount fair value gain (loss) amount fair value gain (loss)

Forward foreign exchange contracts:

Sell:

U.S. dollar ¥25,583 ¥(702) ¥(702) $275,086 $(7,548) $(7,548)

Euro 8,741 600 600 93,989 6,451 6,451

Canadian dollar 1,187 (38) (38) 12,764 (409) (409)

Sterling pound 3,508 195 195 37,720 2,097 2,097

Buy:

U.S. dollar 1,398 46 46 15,032 495 495

Australian dollar 3,516 133 133 37,807 1,430 1,430

Thai baht 5,470 395 395 58,817 4,247 4,247

Japanese yen 3,067 (15) (15) 32,979 (161) (161)

¥52,470 ¥ 614 ¥ 614 $564,194 $ 6,602 $ 6,602

Millions of yen

Contract Estimated Unrealized

As of March 31, 2009 amount fair value gain (loss)

Forward foreign exchange contracts:

Sell:

U.S. dollar ¥ 1,939 ¥(107) ¥(107)

Canadian dollar 296 (4) (4)

Australian dollar 2,409 (144) (144)

Buy:

Thai baht 2,260 (143) (143)

Australian dollar 3,488 (135) (135)

Japanese yen 348 (1) (1)

¥10,740 ¥(534) ¥(534)

For forward foreign exchange contracts, fair values at year-end are estimated based on prevailing forward

exchange rates at that date.

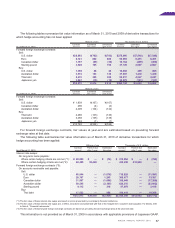

The following table summarizes fair value information as of March 31, 2010 of derivative transactions for which

hedge accounting has been applied:

Millions of yen Thousands of U.S. dollars

Contract Thereof due Estimated Contract Thereof due Estimated

As of March 31, 2010 amount after 1 year fair value amount after 1 year fair value

Interest rate swaps:

On long-term loans payable:

Where certain hedging criteria are not met (*1):

¥ 20,000 ¥ — ¥ (74) $ 215,054 $ — $ (796)

Where certain hedging criteria are met (*2): 40,495 38,400 — 435,430 412,903 —

Forward foreign exchange contracts (*3):

On accounts receivable and payable:

Sell:

U.S. dollar 66,944 — (1,078) 719,828 — (11,591)

Euro 28,707 — 1,245 308,677 — 13,387

Canadian dollar 31,587 — (1,606) 339,645 — (17,269)

Australian dollar 58,545 — (2,195) 629,516 — (23,602)

Sterling pound 9,112 — 318 97,979 — 3,419

Buy:

Thai baht 17,523 — 956 188,419 — 10,280

¥272,913 ¥38,400 ¥(2,434) $2,934,548 $412,903 $(26,172)

(*1) The fair value of these interest rate swaps are based on prices presented by counterparty financial institutions.

(*2) The fair value of these interest rate swaps are, in effect, included in and presented with that of the hedged itemlong-term loans payable. For details, refer

to Note 4, “Financial Instruments.”

(*3) The fair value of these forward foreign exchange contracts are based on prevailing forward exchange rates at the year-end date.

This information is not provided as of March 31, 2009 in accordance with applicable provisions of Japanese GAAP.