Macy's 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-45

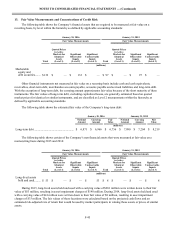

13. Fair Value Measurements and Concentrations of Credit Risk

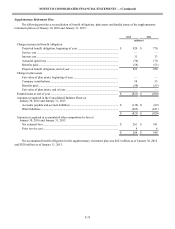

The following table shows the Company’s financial assets that are required to be measured at fair value on a

recurring basis, by level within the hierarchy as defined by applicable accounting standards:

January 30, 2016 January 31, 2015

Fair Value Measurements Fair Value Measurements

Total

Quoted Prices

in Active

Markets for

Identical

Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3) Total

Quoted Prices

in Active

Markets for

Identical

Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

(millions)

Marketable

equity and

debt securities....... $132 $ — $ 132 $ — $ 97 $ — $ 97 $ —

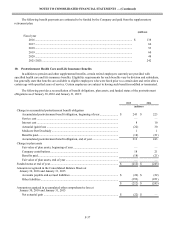

Other financial instruments not measured at fair value on a recurring basis include cash and cash equivalents,

receivables, short-term debt, merchandise accounts payable, accounts payable and accrued liabilities and long-term debt.

With the exception of long-term debt, the carrying amount approximates fair value because of the short maturity of these

instruments. The fair values of long-term debt, excluding capitalized leases, are generally estimated based on quoted

market prices for identical or similar instruments, and are classified as Level 2 measurements within the hierarchy as

defined by applicable accounting standards.

The following table shows the estimated fair value of the Company’s long-term debt:

January 30, 2016 January 31, 2015

Notional

Amount

Carrying

Amount

Fair

Value

Notional

Amount

Carrying

Amount

Fair

Value

(millions)

Long-term debt ...................................................... $ 6,871 $ 6,966 $ 6,756 $ 7,090 $ 7,204 $ 8,219

The following table shows certain of the Company’s non-financial assets that were measured at fair value on a

nonrecurring basis during 2015 and 2014:

January 30, 2016 January 31, 2015

Fair Value Measurements Fair Value Measurements

Total

Quoted Prices

in Active

Markets for

Identical

Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3) Total

Quoted Prices

in Active

Markets for

Identical

Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

(millions)

Long-lived assets

held and used........ $ 53 $ — $ — $ 53 $ 8 $ — $ — $ 8

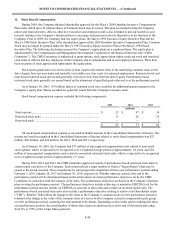

During 2015, long-lived assets held and used with a carrying value of $201 million were written down to their fair

value of $53 million, resulting in asset impairment charges of $148 million. During 2014, long-lived assets held and used

with a carrying value of $41 million were written down to their fair value of $8 million, resulting in asset impairment

charges of $33 million. The fair values of these locations were calculated based on the projected cash flows and an

estimated risk-adjusted rate of return that would be used by market participants in valuing these assets or prices of similar

assets.