Macy's 2015 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2015 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

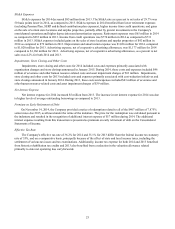

The Company is party to a credit agreement with certain financial institutions providing for revolving credit

borrowings and letters of credit in an aggregate amount not to exceed $1,500 million (which may be increased to $1,750

million at the option of the Company, subject to the willingness of existing or new lenders to provide commitments for

such additional financing) outstanding at any particular time. The agreement is set to expire May 10, 2018. As of

January 30, 2016, and January 31, 2015, there were no revolving credit loans outstanding under this credit agreement, and

there were no borrowings under the agreement throughout all of 2015 and 2014.

The Company is party to a $1,500 million unsecured commercial paper program. The Company may issue and sell

commercial paper in an aggregate amount outstanding at any particular time not to exceed its then-current combined

borrowing availability under the credit agreement with certain financial institutions. During 2015, the Company utilized

seasonal borrowings available under the commercial paper program. The amount of borrowings under the commercial

paper program increased to its highest level for 2015 of approximately $1,100 million during the fourth quarter. As of

January 30, 2016, the Company had no remaining borrowings outstanding under its commercial paper program. The

Company had no commercial paper outstanding under its commercial paper program throughout 2014.

The credit agreement requires the Company to maintain a specified interest coverage ratio for the latest four quarters

of no less than 3.25 and a specified leverage ratio as of and for the latest four quarters of no more than 3.75. The

Company's interest coverage ratio for 2015 was 8.85 and its leverage ratio at January 30, 2016 was 2.21, in each case as

calculated in accordance with the credit agreement. The interest coverage ratio is defined as EBITDA divided by net

interest expense and the leverage ratio is defined as debt divided by EBITDA. For purposes of these calculations EBITDA

is calculated as net income plus interest expense, taxes, depreciation, amortization, non-cash impairment of goodwill,

intangibles and real estate, non-recurring cash charges not to exceed in the aggregate $400 million and extraordinary losses

less interest income and non-recurring or extraordinary gains. Debt is adjusted to exclude the premium on acquired debt

and net interest is adjusted to exclude the amortization of premium on acquired debt and premium on early retirement of

debt.

A breach of a restrictive covenant in the Company's credit agreement or the inability of the Company to maintain the

financial ratios described above could result in an event of default under the credit agreement. In addition, an event of

default would occur under the credit agreement if any indebtedness of the Company in excess of an aggregate principal

amount of $150 million becomes due prior to its stated maturity or the holders of such indebtedness become able to cause it

to become due prior to its stated maturity. Upon the occurrence of an event of default, the lenders could, subject to the

terms and conditions of the credit agreement, elect to declare the outstanding principal, together with accrued interest, to be

immediately due and payable.

Moreover, most of the Company's senior notes and debentures contain cross-default provisions based on the non-

payment at maturity, or other default after an applicable grace period, of any other debt, the unpaid principal amount of

which is not less than $100 million, that could be triggered by an event of default under the credit agreement. In such an

event, the Company's senior notes and debentures that contain cross-default provisions would also be subject to

acceleration.

At January 30, 2016, no notes or debentures contain provisions requiring acceleration of payment upon a debt rating

downgrade. However, the terms of approximately $4,800 million in aggregate principal amount of the Company's senior

notes outstanding at that date require the Company to offer to purchase such notes at a price equal to 101% of their

principal amount plus accrued and unpaid interest in specified circumstances involving both a change of control (as defined

in the applicable indenture) of the Company and the rating of the notes by specified rating agencies at a level below

investment grade.

The Company's board of directors approved an additional authorization to purchase Common Stock of $1,500

million on May 13, 2015. During 2015, the Company repurchased approximately 34.8 million shares of its common stock

for a total of approximately $2,000 million. As of January 30, 2016, the Company had $532 million of authorization

remaining under its share repurchase program. On February 26, 2016, the Company's board of directors approved an

additional $1,500 million in authorization to purchase Common Stock, bringing the Company's remaining authorization

under its share repurchase program including this increase to $2,032 million. The Company may continue or, from time to

time, suspend repurchases of shares under its share repurchase program, depending on prevailing market conditions,

alternate uses of capital and other factors.