Macy's 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-16

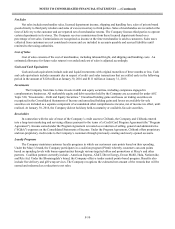

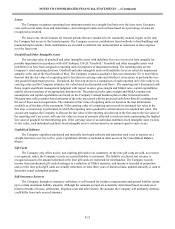

2. Impairments, Store Closing and Other Costs

Impairments, store closing and other costs consist of the following:

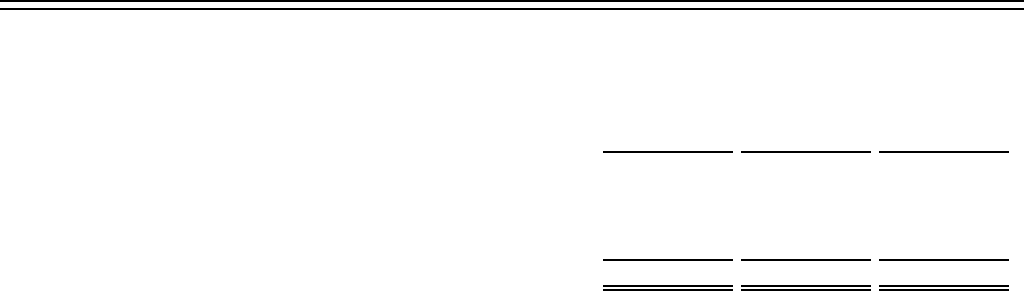

2015 2014 2013

(millions)

Impairments of properties held and used ................................................. $ 148 $ 33 $ 39

Severance ................................................................................................. 123 46 43

Other......................................................................................................... 17 8 6

$ 288 $ 87 $ 88

During January 2016, the Company announced a series of cost-efficiency and process improvement measures,

including organization changes that combine certain region and district organizations of the My Macy's store management

structure, adjusting staffing levels in each Macy's and Bloomingdale's store, implementing a voluntary separation

opportunity for certain senior executives in stores, office and support functions who meet certain age and service

requirements, reducing additional positions in back-office organizations, consolidating the four existing Macy's, Inc. credit

and customer service center facilities into three, and decreasing non-payroll budgets company-wide.

During January 2015, the Company announced a series of initiatives to evolve its business model and invest in

continued growth opportunities, including a restructuring of merchandising and marketing functions at Macy's and

Bloomingdale's consistent with the Company's omnichannel approach to retailing, as well as a series of adjustments to its

field and store operations to increase productivity and efficiency.

During January 2014, the Company announced a series of cost-reduction initiatives, including organization changes

that combine certain region and district organizations of the My Macy’s store management structure and the realignment

and elimination of certain store, central office and administrative functions.

During January 2016, the Company announced the closure of 40 Macy's stores; during January 2015, the Company

announced the closure of fourteen Macy's stores; and during January 2014, the Company announced the closure of five

Macy’s stores.

In connection with these announcements and the plans to dispose of these locations, the Company incurred severance

and other human resource-related costs and other costs related to lease obligations and other store liabilities.

As a result of the Company’s projected undiscounted future cash flows related to certain store locations and other

assets being less than their carrying value, the Company recorded impairment charges, including properties that were the

subject of announced store closings. The fair values of these assets were calculated based on the projected cash flows and

an estimated risk-adjusted rate of return that would be used by market participants in valuing these assets or based on

prices of similar assets.

The Company expects to pay out the majority of the 2015 accrued severance costs, which are included in accounts

payable and accrued liabilities on the Consolidated Balance Sheets, prior to July 30, 2016. The 2014 and 2013 accrued

severance costs, which were included in accounts payable and accrued liabilities on the Consolidated Balance Sheets, were

paid out in the year subsequent to incurring such severance costs.