Macy's 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

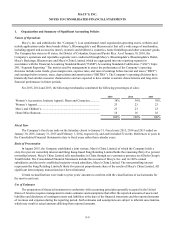

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-17

3. Receivables

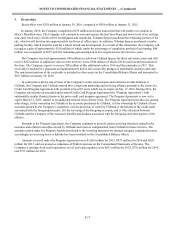

Receivables were $558 million at January 30, 2016, compared to $424 million at January 31, 2015.

In January 2016, the Company completed a $270 million real estate transaction that will enable a re-creation of

Macy’s Brooklyn store. The Company will continue to own and operate the first four floors and lower level of its existing

nine-story retail store, which will be reconfigured and remodeled. Tishman Speyer purchased the remaining portion of the

site, which it will develop into approximately ten floors of office space. In addition, Tishman Speyer purchased a nearby

parking facility, which could be used for a future mixed-use development. As a result of this transaction, the Company will

recognize a gain of approximately $250 million of which, under the percentage of completion method of accounting, $84

million was recognized in 2015 with the remaining gain anticipated to be recognized over the next two years.

The Company received approximately $68 million in cash from Tishman Speyer for these real estate assets and will

receive $202 million of additional cash over the next two years, $100 million of which will be used toward renovation of

the store. The Company expects to receive $95 million of this additional cash in 2016 and the remainder in 2017. This

receivable is backed by a guarantee and approximately half is also secured by pledges of marketable securities and cash.

The non-current portion of the receivable is included in other assets on the Consolidated Balance Sheets and amounted to

$107 million at January 30, 2016.

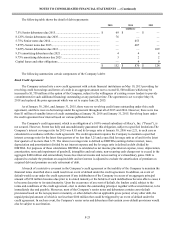

In connection with the sale of most of the Company's credit card accounts and related receivable balances to

Citibank, the Company and Citibank entered into a long-term marketing and servicing alliance pursuant to the terms of a

Credit Card Program Agreement with an initial term of 10 years which was to expire on July 17, 2016. During 2014, the

Company entered into an amended and restated Credit Card Program Agreement (the “Program Agreement”) with

substantially similar financial terms as the prior credit card program agreement. The Program Agreement is now set to

expire March 31, 2025, subject to an additional renewal term of three years. The Program Agreement provides for, among

other things, (i) the ownership by Citibank of the accounts purchased by Citibank, (ii) the ownership by Citibank of new

accounts opened by the Company’s customers, (iii) the provision of credit by Citibank to the holders of the credit cards

associated with the foregoing accounts, (iv) the servicing of the foregoing accounts, and (v) the allocation between

Citibank and the Company of the economic benefits and burdens associated with the foregoing and other aspects of the

alliance.

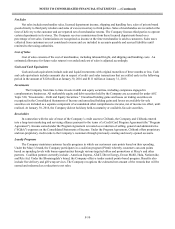

Pursuant to the Program Agreement, the Company continues to provide certain servicing functions related to the

accounts and related receivables owned by Citibank and receives compensation from Citibank for these services. The

amounts earned under the Program Agreement related to the servicing functions are deemed adequate compensation and,

accordingly, no servicing asset or liability has been recorded on the Consolidated Balance Sheets.

Amounts received under the Program Agreement were $1,026 million for 2015, $975 million for 2014 and $928

million for 2013, and are treated as reductions of SG&A expenses on the Consolidated Statements of Income. The

Company’s earnings from credit operations, net of servicing expenses, were $831 million for 2015, $776 million for 2014,

and $731 million for 2013.