Macy's 2015 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2015 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-26

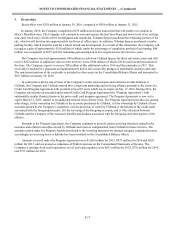

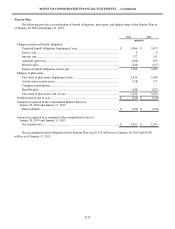

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and deferred

tax liabilities are as follows:

January 30,

2016

January 31,

2015

(millions)

Deferred tax assets

Post employment and postretirement benefits ......................................................... $ 536 $ 586

Accrued liabilities accounted for on a cash basis for tax purposes.......................... 340 305

Long-term debt......................................................................................................... 73 83

Unrecognized state tax benefits and accrued interest............................................... 79 76

State operating loss and credit carryforwards .......................................................... 82 80

Other......................................................................................................................... 206 175

Valuation allowance................................................................................................. (27)(24)

Total deferred tax assets.................................................................................... 1,289 1,281

Deferred tax liabilities

Excess of book basis over tax basis of property and equipment.............................. (1,485)(1,510)

Merchandise inventories .......................................................................................... (606)(585)

Intangible assets ....................................................................................................... (345)(294)

Other......................................................................................................................... (330)(335)

Total deferred tax liabilities .............................................................................. (2,766)(2,724)

Net deferred tax liability ................................................................................... $ (1,477) $ (1,443)

The valuation allowance at January 30, 2016 and January 31, 2015 relates to net deferred tax assets for state net

operating loss and credit carryforwards. The net change in the valuation allowance amounted to an increase of $3 million

for 2015 and an increase of $1 million for 2014.

As of January 30, 2016, the Company had no federal net operating loss carryforwards, state net operating loss

carryforwards of $615 million, and state credit carryforwards of $30 million, which will expire between 2016 and 2035.

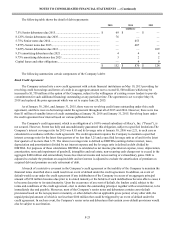

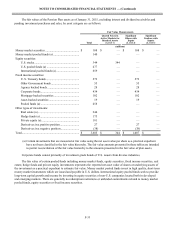

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

January 30,

2016

January 31,

2015

February 1,

2014

(millions)

Balance, beginning of year ...................................................................... $ 172 $ 189 $ 170

Additions based on tax positions related to the current year ................... 30 33 37

Additions for tax positions of prior years ................................................ — — —

Reductions for tax positions of prior years.............................................. (7)(15)(1)

Settlements............................................................................................... (3)(23)(1)

Statute expirations.................................................................................... (14)(12)(16)

Balance, end of year................................................................................. $ 178 $ 172 $ 189

Amounts recognized in the Consolidated Balance Sheets at

January 30, 2016, January 31, 2015 and February 1, 2014

Current income taxes ........................................................................ $ 12 $ 11 $ 31

Long-term deferred income taxes..................................................... 5 6 11

Other liabilities ................................................................................. 161 155 147

$ 178 $ 172 $ 189