Macy's 2015 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2015 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.17

The Company's operations are impacted by competitive pressures from department stores, specialty stores, mass

merchandisers, online retailers and all other retail channels. The Company's operations are also impacted by general

consumer spending levels, including the impact of general economic conditions, consumer disposable income levels,

consumer confidence levels, the availability, cost and level of consumer debt, the costs of basic necessities and other goods

and the effects of weather or natural disasters and other factors over which the Company has little or no control.

In recent years, consumer spending levels have been affected to varying degrees by a number of factors, including

modest economic growth, uncertainty regarding governmental spending and tax policies, unemployment levels, tightened

consumer credit, an improving housing market and a fluctuating stock market. In addition, consumer spending levels of

international customers are impacted by the strength of the U.S. dollar relative to foreign currencies. These factors have

affected to varying degrees the amount of funds that consumers are willing and able to spend for discretionary purchases,

including purchases of some of the merchandise offered by the Company.

All economic conditions ultimately affect the Company's overall operations. However, the effects of economic

conditions can be experienced differently and at different times, in the various geographic regions in which the Company

operates, in relation to the different types of merchandise that the Company offers for sale, or in relation to each of the

Company's branded operations.

2015 Overview

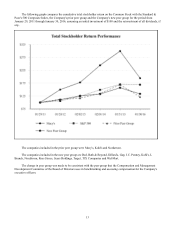

This was a challenging year, following six consecutive years of improved financial performance. However, against

the backdrop of a challenging macroeconomic environment, unfavorable weather and weaker international tourist sales, the

Company continued to see a benefit from the disciplined implementation of its strategies.

Selected results of 2015 include:

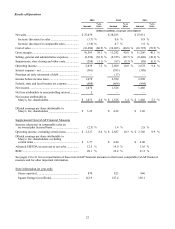

• Comparable sales on an owned basis decreased 3.0% and comparable sales on an owned plus licensed basis

decreased 2.5%.

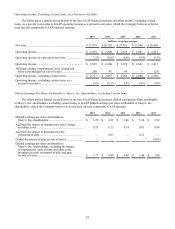

• Operating income for 2015 was $2.327 billion or 8.6% of sales, excluding impairments, store closing and other

costs, a decrease of 19% and 170 basis points as a percent of sales from 2014 on a comparable basis.

• Diluted earnings per share attributable to Macy's, Inc. shareholders, excluding certain items, declined 14% to

$3.77 in 2015 from $4.40 in 2014.

• Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization, impairments, store closing and

other costs) as a percent to net sales was 12.5% in 2015, as compared to 14.0% in 2014.

• Return on invested capital ("ROIC"), a key measure of operating productivity, was 20.1%, a decrease from

22.4% in 2014.

• The Company repurchased 34.8 million shares of its common stock for $2,000 million in 2015, and increased its

annualized dividend rate to $1.44 per share. This annualized dividend rate represents an increase of 15% and is

the fifth increase in the dividend in the past four years.

See pages 18 to 21 for reconciliations of the non-GAAP financial measures presented above to the most comparable GAAP

financial measures and other important information.