Macy's 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.16

In March 2015, the Company completed its acquisition of Bluemercury, Inc., a luxury beauty products and spa

retailer. The Company is focused on accelerating the growth of sales in freestanding Bluemercury stores in urban and

suburban markets, enhancing its online capabilities and adding selected Bluemercury products and boutiques to Macy's

stores nationwide. Since the March acquisition, the Company has opened 15 new freestanding Bluemercury store locations

bringing the total freestanding store locations to 77 and has also opened four stores inside existing Macy's stores.

In May 2015, in conjunction with American Express, the Company helped launch Plenti, the innovative loyalty

program that brings powerful brands together to give customers the chance to earn and redeem points where they choose.

The loyalty program is free to join and members earn points on virtually all purchases at Macy's and other businesses that

have joined as Plenti partners.

Additionally, in 2015, the Company opened the first six pilot stores in Macy's new off-price business, Macy's

Backstage, in the New York City metro area. The Macy's Backstage locations average about 30,000 square feet and sell an

assortment of women's, men's and children's apparel, shoes, fashion accessories, housewares, home textiles, intimate

apparel and jewelry.

In August 2015, the Company established a joint venture, Macy's China Limited, of which the Company holds a

sixty-five percent ownership interest and Hong Kong-based Fung Retailing Limited holds the remaining thirty-five percent

ownership interest. Macy's China Limited began selling merchandise in China in the fourth quarter of 2015 through an e-

commerce presence on Alibaba Group's Tmall Global. The Company's periodic reporting now includes the consolidated

results of operations of Macy's China Limited, with the thirty-five percent ownership reported as a noncontrolling interest.

In October 2015, the Company announced a real estate transaction related to its downtown Seattle store location. The

Company has sold the top four floors of underutilized space in this retail location for $65 million in cash. As a result of this

transaction, the Company recorded a gain of approximately $57 million in the third quarter of 2015.

In January 2016, the Company completed a $270 million real estate transaction that will enable a re-creation of

Macy’s Brooklyn store. The Company will continue to own and operate the first four floors and lower level of its existing

nine-story retail store, which will be reconfigured and remodeled. Tishman Speyer purchased the remaining portion of the

site, which it will develop into approximately ten floors of office space. In addition, Tishman Speyer purchased a nearby

parking facility, which could be used for a future mixed-use development. As a result of this transaction, the Company will

recognize a gain of approximately $250 million of which, under the percentage of completion method of accounting, $84

million was recognized in 2015 with the remaining gain anticipated to be recognized over the next two years.

Also in 2015, the Company launched the marketing of potential partnership and joint venture transactions for certain

of its real estate. This includes the owned mall-based properties, as well as Macy's flagship real estate assets in Manhattan

(Herald Square), San Francisco (Union Square), Chicago (State Street) and Minneapolis (downtown Nicollet Mall). In

addition, the Company will also continue to pursue selected real estate dispositions and monetize assets in instances where

the business is simultaneously enhanced or where the value of real estate significantly outweighs the value of the retail

business.

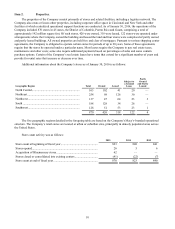

During 2014, the Company opened three new Macy's stores in the Bronx, NY; Las Vegas, NV; and Sarasota, FL, one

Bloomingdale's replacement store in Palo Alto, CA, and one new Bloomingdale's furniture clearance store in Wayne, NJ.

During 2015, the Company opened 26 stores including a Macy's in Ponce, PR, a Bloomingdale's in Honolulu, HI, 15

Bluemercury, six Macy's Backstage and three Bloomingdale's Outlets. The Company has announced that in 2016 it intends

to open one new Macy's store in Kapolei, HI, approximately 42 new Bluemercury locations (24 freestanding and 18 inside

existing Macy's stores) and 16 new Macy's Backstage locations (one freestanding and 15 inside existing Macy's stores).

In 2017, the Company intends to open a new Macy's store in Murray, UT, a Macy's replacement store in Los Angeles,

CA, and a new Bloomingdale's store in San Jose, CA. In 2018, the Company intends to open a new Bloomingdale's store

in Norwalk, CT. In addition, a new Bloomingdale's store is expected to open in Kuwait in 2017 and new Macy's and

Bloomingdale's stores are planned to open in Abu Dhabi, United Arab Emirates in 2018 under license agreements with Al

Tayer Group, LLC.