Macy's 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-28

9. Retirement Plans

The Company has defined contribution plans which cover substantially all employees who work 1,000 hours or more

in a year. In addition, the Company has a funded defined benefit plan (“Pension Plan”) and an unfunded defined benefit

supplementary retirement plan (“SERP”), which provides benefits, for certain employees, in excess of qualified plan

limitations. Effective January 1, 2012, the Pension Plan was closed to new participants, with limited exceptions, and

effective January 2, 2012, the SERP was closed to new participants.

In February 2013, the Company announced changes to the Pension Plan and SERP whereby eligible employees no

longer earn future pension service credits after December 31, 2013, with limited exceptions. All retirement benefits

attributable to service in subsequent periods are provided through defined contribution plans.

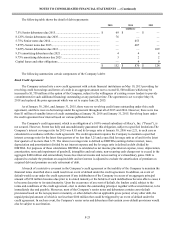

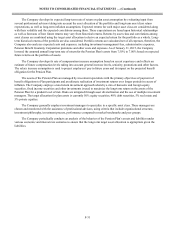

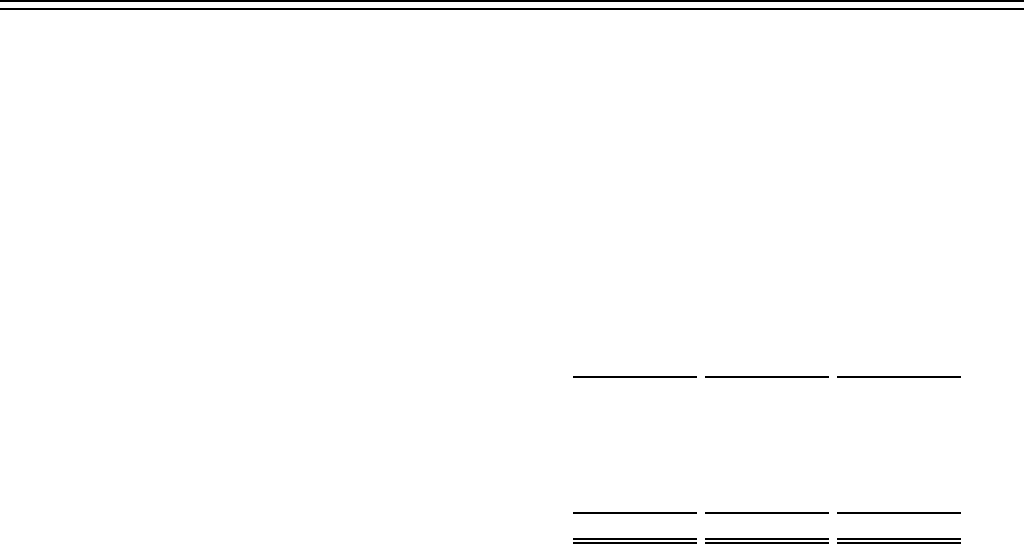

Retirement expenses included the following components:

2015 2014 2013

(millions)

401(k) Qualified Defined Contribution Plan...................................... $ 88 $ 89 $ 24

Non-Qualified Defined Contribution Plan ......................................... 2 2 —

Pension Plan ....................................................................................... (54)(64) 154

Supplementary Retirement Plan......................................................... 41 38 57

$ 77 $ 65 $ 235

Defined Contribution Plans

The Company has a qualified plan that permits participating associates to defer eligible compensation up to the

maximum limits allowable under the Internal Revenue Code. Beginning January 1, 2014, the Company has a non-qualified

plan which permits participating associates to defer eligible compensation above the limits of the qualified plan. The

Company contributes a matching percentage of employee contributions under both the qualified and non-qualified plans.

Effective January 1, 2014, the Company's matching contribution to the qualified plan was enhanced for all participating

employees, with limited exceptions. Prior to January 1, 2014, the matching contribution rate under the qualified plan was

higher for those employees not eligible for the Pension Plan than for employees eligible for the Pension Plan.

The liability related to the qualified plan matching contribution, which is reflected in accounts payable and accrued

liabilities on the Consolidated Balance Sheets, was $97 million at January 30, 2016 and January 31, 2015. Expense related

to matching contributions for the qualified plan amounted to $88 million for 2015, $89 million for 2014 and $24 million

for 2013.

At January 30, 2016 and January 31, 2015, the liability under the non-qualified plan, which is reflected in other

liabilities on the Consolidated Balance Sheets, was $13 million and $4 million, respectively. The liability related to the

non-qualified plan matching contribution, which is reflected in accounts payable and accrued liabilities on the Consolidated

Balance Sheets, was $2 million at January 30, 2016 and January 31, 2015. Expense related to matching contributions for

the non-qualified plan amounted to $2 million for 2015 and 2014. In connection with the non-qualified plan, the Company

had mutual fund investments at January 30, 2016 and January 31, 2015 of $13 million and $4 million, respectively, which

are included in prepaid expenses and other current assets on the Consolidated Balance Sheets.

The Company has an additional deferred compensation plan wherein eligible executives elected to defer a portion of

their compensation each year as either stock credits or cash credits. Effective January 1, 2015, no additional compensation

is eligible for deferral. The Company has transfered shares to a trust to cover the number estimated for distribution on

account of stock credits currently outstanding. At January 30, 2016 and January 31, 2015, the liability under the plan,

which is reflected in other liabilities on the Consolidated Balance Sheets, was $39 million and $42 million, respectively.

Expense for 2015, 2014 and 2013 was immaterial.