Macy's 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-20

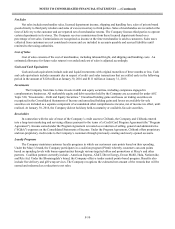

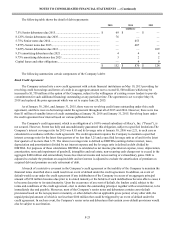

5. Goodwill and Other Intangible Assets

The following summarizes the Company’s goodwill and other intangible assets:

January 30,

2016

January 31,

2015

(millions)

Non-amortizing intangible assets

Goodwill ................................................................................................................... $ 9,279 $ 9,125

Accumulated impairment losses ............................................................................... (5,382)(5,382)

3,897 3,743

Tradenames............................................................................................................... 414 414

$ 4,311 $ 4,157

Amortizing intangible assets

Favorable leases........................................................................................................ $ 149 $ 177

Tradenames............................................................................................................... 43 —

Customer relationships ............................................................................................. — 188

192 365

Accumulated amortization

Favorable leases........................................................................................................ (90)(106)

Tradenames............................................................................................................... (2) —

Customer relationships ............................................................................................. — (177)

(92)(283)

$ 100 $ 82

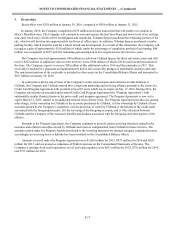

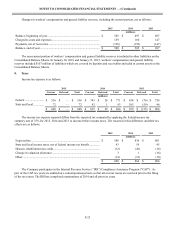

In March 2015, the Company completed its acquisition of Bluemercury, Inc., a luxury beauty products and spa

retailer. Goodwill during 2015 increased as a result of this acquisition. Also as a result of the acquisition of Bluemercury,

the Company established intangible assets relating to definite lived tradenames and favorable leases.

Definite lived tradenames are being amortized over their respective useful lives of 20 years. Favorable lease

intangible assets are being amortized over their respective lease terms (weighted average remaining life of approximately

six years). Customer relationship intangible assets relating to the acquisition of The May Department Stores Company are

fully amortized as of January 30, 2016.

Intangible amortization expense amounted to $23 million for 2015, $31 million for 2014 and $34 million for 2013.

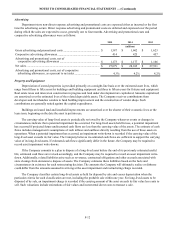

Future estimated intangible amortization expense is shown below:

(millions)

Fiscal year

2016.................................................................................................................................... $ 10

2017.................................................................................................................................... 10

2018.................................................................................................................................... 10

2019.................................................................................................................................... 9

2020.................................................................................................................................... 7