Macy's 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

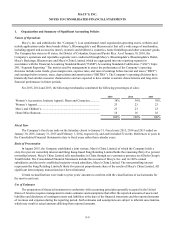

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-11

Merchandise Inventories

Merchandise inventories are valued at lower of cost or market using the last-in, first-out (LIFO) retail inventory

method. Under the retail inventory method, inventory is segregated into departments of merchandise having similar

characteristics, and is stated at its current retail selling value. Inventory retail values are converted to a cost basis by

applying specific average cost factors for each merchandise department. Cost factors represent the average cost-to-retail

ratio for each merchandise department based on beginning inventory and the annual purchase activity. At January 30, 2016

and January 31, 2015, merchandise inventories valued at LIFO, including adjustments as necessary to record inventory at

the lower of cost or market, approximated the cost of such inventories using the first-in, first-out (FIFO) retail inventory

method. The application of the LIFO retail inventory method did not result in the recognition of any LIFO charges or

credits affecting cost of sales for 2015, 2014 or 2013. The retail inventory method inherently requires management

judgments and estimates, such as the amount and timing of permanent markdowns to clear unproductive or slow-moving

inventory, which may impact the ending inventory valuation as well as gross margins.

Permanent markdowns designated for clearance activity are recorded when the utility of the inventory has

diminished. Factors considered in the determination of permanent markdowns include current and anticipated demand,

customer preferences, age of the merchandise and fashion trends. When a decision is made to permanently markdown

merchandise, the resulting gross margin reduction is recognized in the period the markdown is recorded.

Physical inventories are generally taken within each merchandise department annually, and inventory records are

adjusted accordingly, resulting in the recording of actual shrinkage. Physical inventories are taken at all store locations for

substantially all merchandise categories approximately three weeks before the end of the year. Shrinkage is estimated as a

percentage of sales at interim periods and for this approximate three-week period, based on historical shrinkage rates.

While it is not possible to quantify the impact from each cause of shrinkage, the Company has loss prevention programs

and policies that are intended to minimize shrinkage, including the use of radio frequency identification cycle counts and

interim inventories to keep the Company's merchandise files accurate.

Vendor Allowances

The Company receives certain allowances as reimbursement for markdowns taken and/or to support the gross

margins earned in connection with the sales of merchandise. These allowances are recognized when earned in accordance

with ASC Subtopic 605-50, “Customer Payments and Incentives.” The Company also receives advertising allowances from

approximately 1,000 of its merchandise vendors pursuant to cooperative advertising programs, with some vendors

participating in multiple programs. These allowances represent reimbursements by vendors of costs incurred by the

Company to promote the vendors’ merchandise and are netted against advertising and promotional costs when the related

costs are incurred in accordance with ASC Subtopic 605-50. Advertising allowances in excess of costs incurred are

recorded as a reduction of merchandise costs and, ultimately, through cost of sales when the merchandise is sold.

The arrangements pursuant to which the Company’s vendors provide allowances, while binding, are generally

informal in nature and one year or less in duration. The terms and conditions of these arrangements vary significantly from

vendor to vendor and are influenced by, among other things, the type of merchandise to be supported.