Macy's 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

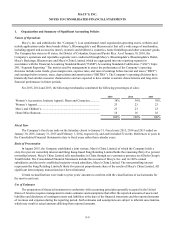

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-15

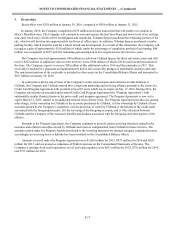

In April 2015, the FASB issued ASU No. 2015-04, Compensation - Retirement Benefits (Topic 715), which provides

a practical expedient that permits an entity with a fiscal year-end that does not coincide with a month-end to measure

defined benefit plan assets and obligations using the month-end that is closest to the entity's fiscal year-end and apply that

practical expedient consistently from year to year. This guidance is effective for public business entities for years beginning

after December 15, 2015. Earlier application is permitted, and the Company has adopted this guidance as of January 30,

2016. The adoption of ASU 2015-04 did not have a material impact on the Company's consolidated financial position,

results of operations, and cash flows.

Also in April 2015, the FASB issued ASU No. 2015-03, Interest - Imputation of Interest (Subtopic 835-30), which is

intended to simplify the presentation of debt issuance costs. This guidance requires debt issuance costs related to a

recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt

liability, consistent with debt discounts. This guidance is effective for public business entities for years beginning after

December 15, 2015. Earlier adoption is permitted, and the Company has adopted this guidance as of January 30, 2016. The

adoption of ASU 2015-03 did not have a material impact on the Company's consolidated financial position, results of

operations, and cash flows.