Macy's 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-23

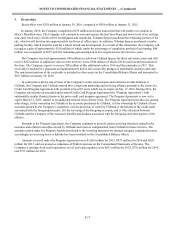

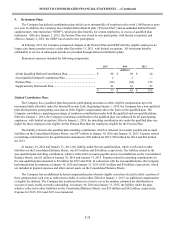

The following table shows the detail of debt repayments:

2015 2014 2013

(millions)

7.5% Senior debentures due 2015 ............................................................ $ 69 $ — $ —

8.125% Senior debentures due 2035 ........................................................ 76 — —

5.75% Senior notes due 2014................................................................... — 453 —

7.875% Senior notes due 2015................................................................. — 407 —

7.625% Senior debentures due 2013 ........................................................ — — 109

9.5% amortizing debentures due 2021 ..................................................... 4 4 4

9.75% amortizing debentures due 2021 ................................................... 3 2 2

Capital leases and other obligations ......................................................... — 4 9

$ 152 $ 870 $ 124

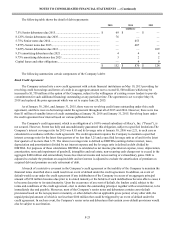

The following summarizes certain components of the Company’s debt:

Bank Credit Agreement

The Company entered into a new credit agreement with certain financial institutions on May 10, 2013 providing for

revolving credit borrowings and letters of credit in an aggregate amount not to exceed $1,500 million (which may be

increased to $1,750 million at the option of the Company, subject to the willingness of existing or new lenders to provide

commitments for such additional financing) outstanding at any particular time. The agreement is set to expire May 10,

2018 and replaced the prior agreement which was set to expire June 20, 2015.

As of January 30, 2016, and January 31, 2015, there were no revolving credit loans outstanding under this credit

agreement, and there were no borrowings under the agreement throughout all of 2015 and 2014. However, there were less

than $1 million of standby letters of credit outstanding at January 30, 2016 and January 31, 2015. Revolving loans under

the credit agreement bear interest based on various published rates.

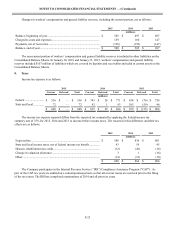

The Company's credit agreement, which is an obligation of a 100%-owned subsidiary of Macy’s, Inc. (“Parent”), is

not secured. However, Parent has fully and unconditionally guaranteed this obligation, subject to specified limitations.The

Company’s interest coverage ratio for 2015 was 8.85 and its leverage ratio at January 30, 2016 was 2.21, in each case as

calculated in accordance with the credit agreement. The credit agreement requires the Company to maintain a specified

interest coverage ratio for the latest four quarters of no less than 3.25 and a specified leverage ratio as of and for the latest

four quarters of no more than 3.75. The interest coverage ratio is defined as EBITDA (earnings before interest, taxes,

depreciation and amortization) divided by net interest expense and the leverage ratio is defined as debt divided by

EBITDA. For purposes of these calculations EBITDA is calculated as net income plus interest expense, taxes, depreciation,

amortization, non-cash impairment of goodwill, intangibles and real estate, non-recurring cash charges not to exceed in the

aggregate $400 million and extraordinary losses less interest income and non-recurring or extraordinary gains. Debt is

adjusted to exclude the premium on acquired debt and net interest is adjusted to exclude the amortization of premium on

acquired debt and premium on early retirement of debt.

A breach of a restrictive covenant in the Company’s credit agreement or the inability of the Company to maintain the

financial ratios described above could result in an event of default under the credit agreement. In addition, an event of

default would occur under the credit agreement if any indebtedness of the Company in excess of an aggregate principal

amount of $150 million becomes due prior to its stated maturity or the holders of such indebtedness become able to cause it

to become due prior to its stated maturity. Upon the occurrence of an event of default, the lenders could, subject to the

terms and conditions of the credit agreement, elect to declare the outstanding principal, together with accrued interest, to be

immediately due and payable. Moreover, most of the Company’s senior notes and debentures contain cross-default

provisions based on the non-payment at maturity, or other default after an applicable grace period, of any other debt, the

unpaid principal amount of which is not less than $100 million that could be triggered by an event of default under the

credit agreement. In such an event, the Company’s senior notes and debentures that contain cross-default provisions would

also be subject to acceleration.