Macy's 2015 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2015 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

| The Agility to Adapt

Reducing Expenses to Fund Growth

Beginning in 2015 an

d

continuing in 2016, t

h

e company is re

d

ucing

e

x

penses

an

d

tig

h

tening capita

l

spen

d

ing so we can reinvest in

growth initiatives. By doing so, we believe we can accelerate the to

p

line while making progress toward the company’s goal of re-attaining

over time an EBITDA rate as a percent

of

t

sales

f

of

14

f

percent.

Our target is to reduce annual SG&A expenses by $500 millio

n

(net of growth initiatives) from previously planned levels by 2018

,

with incremental progress in 2016 and 2017 toward that goal. Goin

g

into 2016, we already have identified and announced approximatel

y

$400 million in annualized reductions. Macy’s, Inc. will reduce capita

l

spending to an estimated $900 million in 2016 from the $1.1 billion

in capital spent in 2015 – which still provides us with ample resource

s

for major investments in technology, digital advancement, physica

l

improvements to top stores and other levers of growth.

Adjusting Our Customer Touchpoints

As customer sho

pp

ing

p

atterns continue to evolve across

stores and digital, we have re

fi

ned our touchpoints

f

or interactin

g

with shoppers.

Our we

b

sites an

d

mo

b

i

l

e apps

h

ave continue

d

to improve,

becoming more robust with merchandise of

ferings, content and

f

f

f

unctionality. Ful

fi

llment capabilities are expanding with nationa

l

availability o

f

Buy Online Pickup in Store and Same Day Delivery in

an increasing number o

f

markets at Macy’s and Bloomingdale’s. In

2015, we opened our

fif

th direct-to-consumer

f

ul

fi

llment megacenter

,

a 1.3 million-square-

f

oot

f

acility in Tulsa, OK.

Meanwhile, we are committed to maintaining a healthy port

f

olio o

f

stores in t

h

e

b

est

l

ocations across America –

b

ot

h

to serve s

h

opper

s

who walk through the door and to

f

ul

fi

ll orders that are shippe

d

d

irect

l

y to customers aroun

d

t

h

e country. T

h

e company c

l

ose

d

4

1

underper

f

orming Macy’s stores (out o

f

a previous total o

f

about 77

0

Mac

y

’s stores) in 2015. We wi

ll

continue to a

dd

stores se

l

ective

ly

w

h

i

l

e

a

l

so

b

eing

d

isci

pl

ine

d

a

b

out c

l

osing stores t

h

at are un

p

ro

d

uctive o

r

no longer robust sho

pp

ing destinations because o

f

changes in th

e

l

oca

l

retai

l

s

h

o

pp

ing

l

an

d

sca

p

e

.

Pursuing Value from Real Estate

The com

p

any also is

p

ursuing the creation of shareholder valu

e

th

r

ough various initiatives to monetize the com

p

any’s significant rea

l

estate assets or through

p

artnershi

p

s or joint venture transaction

s

for the com

p

any’s owned mall-based

p

ro

p

erties, as well as Macy’

s

flagship real estate assets in Manhattan, San Francisco, Chicag

o

an

d

Minneapo

l

is.

In 2015, for example, the company sold the underutilized upper

floors of the Macy’s store in downtown Seattle for $65 million to

a

r

eal estate developer that is converting it to office use. In Brooklyn,

Macy’s, Inc. completed a $270 million deal with Tishman Speyer that

will enable a re-creation of Macy’s Brooklyn store and further enlive

n

one of New York City’s most dynamic neighborhoods.

We believe these types of transactions, as well as the potentia

l

partnerships and joint ventures being explored, can create significan

t

value while also contributing to the success of our retail operations.

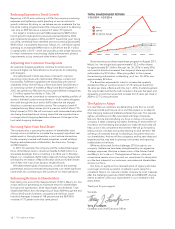

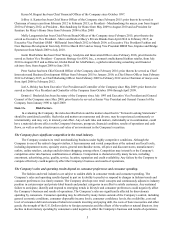

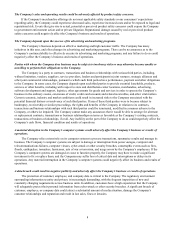

Enhancing Returns to Shareholders

Even taking into account the disa

pp

ointment of 2015, Macy’s, Inc. ha

s

at

r

ac

k record of generating an im

p

ressive return for shareholder

s

through

p

rice a

pp

reciation, share re

p

urchases and dividends. Total

Shareholder Return from the be

g

innin

g

of fiscal 2009 throu

g

h the end

of fiscal 2015 was 412

p

ercent, com

p

ared with the Dow Jone

s

Industrial Average’s increase of 148

p

ercent and the S&P 500’

s

increase of 173

p

ercent over that same

p

eriod.

Since resuming our s

h

are re

p

urc

h

ase

p

rogram in August 2011

,

M

acy’s, Inc. has bought back approximately 152.2 million share

s

f

or approximately $7.3 billion through Jan. 30, 2016. In early 2016,

our board of directors increased the com

p

any’s share re

p

urchase

authorization by $1.5 billion. After giving effect to this increase,

t

he remaining authorization outstanding, as of Jan. 30, 2016, was

a

pp

roximately

$

2 billion.

T

h

e Boar

d

a

l

so ex

p

resse

d

its intent to increase t

h

e

q

uarter

ly

d

ividend on Macy's common stock to 37.75 cents

p

er share from

36 cents

p

er share, effective with the July 1, 2016, dividend

p

ayment

.

T

he July dividend will be the sixth increase in the

p

ast five years an

d

re

p

resents a more than seven-fold increase from 5 cents

p

er share i

n

2009 to 37.75 cents

p

er share.

The Agility to Adapt

I

t is clear that our customers are demanding more

f

rom us in bot

h

w

h

a

t

we provide and how we do it, and they expect us to adapt t

o

t

heir changing tastes and pre

f

erences

f

aster than ever. This requires

agility—something not o

f

ten associated with large companies

l

ike ours. But we are intensi

f

ying our

f

ocus on being a more agile

company. It takes cultivating top talent,

f

ostering an environment o

f

innovation and harnessing data analytics to make decisions that wil

l

help us win in this competitive environment. We will go

f

orward b

y

t

esting various concepts and quickly reacting to what we learn. W

e

w

ill let go o

f

initiatives that are not leading to long term returns to

our shareholders. And we will be courageous and try new ideas and

experiences that may lead to growing our business and capturin

g

m

arket share in the

f

uture

.

While we did not ask

f

or the challenges 2015 brought to ou

r

com

p

any, I believe we have been strengthened by our aggressive

strategic res

p

onses. We have a clearer vision of the future of retai

l

and Mac

y

’s, Inc.’s rol

e

i

n

i

t.

Th

e

ke

y

stone

s

of

fashion,

f

v

a

l

ue

a

n

d

convenience remain at our core an

d

our commitment to

d

oing w

h

a

t

is in the best interest of our customers, associates and shareholders

r

e

m

a

in

sou

rf

ocus.

Our focus on agility and our renewed sense of urgency will mak

e

us stronger and more success

f

ul. A setback is just a setu

pf

or

a

comeback. Macy’s, Inc. became a better com

p

any by most measure

s

after the challenging

p

eriods of 2001/2002 and 2008/2009. And we

intend to deliver continuous im

p

rovement in our comeback in the

years ahead

.

T

hank you for your su

pp

ort

.

Sincerely,

Terry J. Lun

d

gren

Chairman and Chief Executive Officer

Cha

irm

an a

nd C

hie

fEx

ecu

tiv

eOf

fice

r

Macy’s

S&P 500

DJ Industrial Average

412%

173%

148%

1/30/09 1/29/10 1/28/11 1/27/12 2/1/13 1/31/14 1/30/15 1/29/16

T

OTAL SHAREHOLDER RETUR

N

1/30/2009 - 1/29/2016