Macy's 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-12

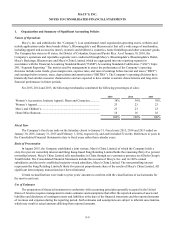

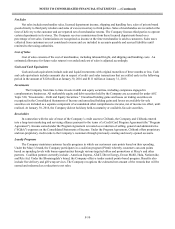

Advertising

Department store non-direct response advertising and promotional costs are expensed either as incurred or the first

time the advertising occurs. Direct response advertising and promotional costs are deferred and expensed over the period

during which the sales are expected to occur, generally one to four months. Advertising and promotional costs and

cooperative advertising allowances were as follows:

2015 2014 2013

(millions)

Gross advertising and promotional costs ................................................. $ 1,587 $ 1,602 $ 1,623

Cooperative advertising allowances......................................................... 414 425 457

Advertising and promotional costs, net of

cooperative advertising allowances ...................................................... $ 1,173 $ 1,177 $ 1,166

Net sales ................................................................................................... $ 27,079 $ 28,105 $ 27,931

Advertising and promotional costs, net of cooperative

advertising allowances, as a percent to net sales .................................. 4.3% 4.2% 4.2%

Property and Equipment

Depreciation of owned properties is provided primarily on a straight-line basis over the estimated asset lives, which

range from fifteen to fifty years for buildings and building equipment and three to fifteen years for fixtures and equipment.

Real estate taxes and interest on construction in progress and land under development are capitalized. Amounts capitalized

are amortized over the estimated lives of the related depreciable assets. The Company receives contributions from

developers and merchandise vendors to fund building improvement and the construction of vendor shops. Such

contributions are generally netted against the capital expenditures.

Buildings on leased land and leasehold improvements are amortized over the shorter of their economic lives or the

lease term, beginning on the date the asset is put into use.

The carrying value of long-lived assets is periodically reviewed by the Company whenever events or changes in

circumstances indicate that a potential impairment has occurred. For long-lived assets held for use, a potential impairment

has occurred if projected future undiscounted cash flows are less than the carrying value of the assets. The estimate of cash

flows includes management’s assumptions of cash inflows and outflows directly resulting from the use of those assets in

operations. When a potential impairment has occurred, an impairment write-down is recorded if the carrying value of the

long-lived asset exceeds its fair value. The Company believes its estimated cash flows are sufficient to support the carrying

value of its long-lived assets. If estimated cash flows significantly differ in the future, the Company may be required to

record asset impairment write-downs.

If the Company commits to a plan to dispose of a long-lived asset before the end of its previously estimated useful

life, estimated cash flows are revised accordingly, and the Company may be required to record an asset impairment write-

down. Additionally, related liabilities arise such as severance, contractual obligations and other accruals associated with

store closings from decisions to dispose of assets. The Company estimates these liabilities based on the facts and

circumstances in existence for each restructuring decision. The amounts the Company will ultimately realize or disburse

could differ from the amounts assumed in arriving at the asset impairment and restructuring charge recorded.

The Company classifies certain long-lived assets as held for disposal by sale and ceases depreciation when the

particular criteria for such classification are met, including the probable sale within one year. For long-lived assets to be

disposed of by sale, an impairment charge is recorded if the carrying amount of the asset exceeds its fair value less costs to

sell. Such valuations include estimations of fair values and incremental direct costs to transact a sale.