Macy's 2015 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2015 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.27

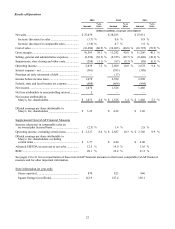

Liquidity and Capital Resources

The Company's principal sources of liquidity are cash from operations, cash on hand and the credit facility described

below.

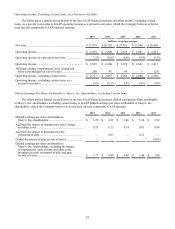

Operating Activities

Net cash provided by operating activities was $1,984 million in 2015 compared to $2,709 million in 2014, reflecting

lower net income.

Investing Activities

Net cash used by investing activities for 2015 was $1,092 million, compared to net cash used by investing activities

of $970 million for 2014. Investing activities for 2015 includes the acquisition of Bluemercury, Inc., net of cash acquired,

for $212 million. Investing activities for 2015 also includes purchases of property and equipment totaling $777 million and

capitalized software of $336 million, compared to purchases of property and equipment totaling $770 million and

capitalized software of $298 million for 2014. Cash flows from investing activities included $204 million and $172 million

from the disposition of property and equipment for 2015 and 2014, respectively. At January 30, 2016, the Company had

approximately $57 million of cash in a qualified escrow account, included in prepaid expenses and other current assets, to

be utilized for potential tax deferred like-kind exchange transactions.

During 2015, the Company opened one new Macy's store, one new Bloomingdale's store, three new Bloomingdale's

Outlet stores and six new Macy's Backstage stores. Additionally, 15 new Bluemercury stores have opened since the

acquisition in March 2015. During 2014, the Company opened three new Macy's stores, one Bloomingdale's replacement

store, and one new Bloomingdale's furniture clearance store.

In 2015, the Company launched the marketing of potential partnership and joint venture transactions for certain of its

real estate. This includes the owned mall-based properties, as well as Macy's flagship real estate assets in Manhattan

(Herald Square), San Francisco (Union Square), Chicago (State Street) and Minneapolis (downtown Nicollet Mall). In

addition, the Company will also continue to pursue selected real estate dispositions and monetize assets in instances where

the business is simultaneously enhanced or where the value of real estate significantly outweighs the value of the retail

business.

Financing Activities

Net cash used by the Company for financing activities was $2,029 million for 2015, including the acquisition of the

Company's common stock under its share repurchase program at an approximate cost of $2,000 million, the repayment of

$152 million of debt and the payment of $456 million of cash dividends, partially offset by the issuance of $500 million of

debt, the issuance of $163 million of common stock, primarily related to the exercise of stock options, and a decrease in

outstanding checks of $83 million. $500 million aggregate principal amount of 3.450% senior unsecured notes due 2021

were issued in 2015.

On June 1, 2015, the Company repaid $69 million of 7.5% senior debentures at maturity. On August 17, 2015, the

Company redeemed at par the principal amount of $76 million of 8.125% senior debentures due 2035, pursuant to the

terms of the debentures. Interest expense in 2015 benefited from the recognition of unamortized debt premium associated

with the $76 million of 8.125% senior debentures.

Net cash used by the Company for financing activities was $1,766 million for 2014 and included the acquisition of

the Company's common stock under its share repurchase program at an approximate cost of $1,900 million, the repayment

of $870 million of debt and the payment of $421 million of cash dividends, partially offset by the issuance of $1,050

million of debt, the issuance of $258 million of common stock, primarily related to the exercise of stock options, and an

increase in outstanding checks of $133 million. $550 million aggregate principal amount of 4.5% senior notes due 2034

and $500 million aggregate principal amount of 3.625% senior unsecured notes due 2024 were issued in 2014.

On November 14, 2014, the Company provided a notice of redemption related to all of the $407 million of 7.875%

senior notes due 2015, as allowed under the terms of the indenture. The price for the redemption was calculated pursuant to

the indenture and resulted in the recognition of additional interest expense of $17 million during 2014. This additional

interest expense is presented as premium on early retirement of debt on the Consolidated Statements of Income. Debt

repaid during 2014 also included $453 million of 5.75% senior notes due July 15, 2014 paid at maturity.