Macy's 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-33

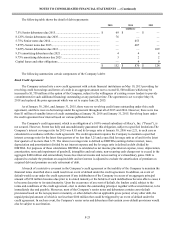

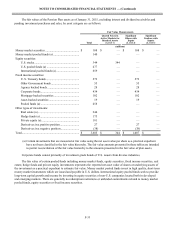

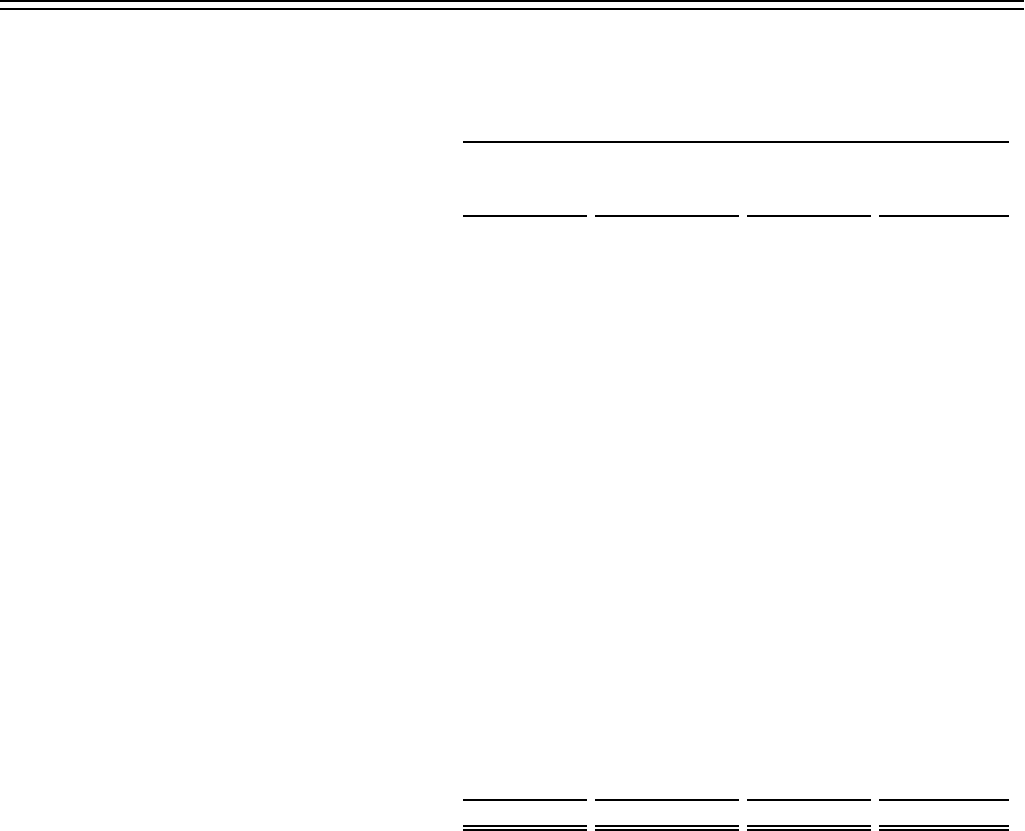

The fair values of the Pension Plan assets as of January 31, 2015, excluding interest and dividend receivables and

pending investment purchases and sales, by asset category are as follows:

Fair Value Measurements

Total

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

(millions)

Money market securities .............................................. $ 108 $ — $ 108 $ —

Money market pooled funds (a) ................................... 140 — — —

Equity securities:

U.S. stocks............................................................. 344 344 — —

U.S. pooled funds (a) ............................................ 477 — — —

International pooled funds (a) ............................... 659 — — —

Fixed income securities:

U. S. Treasury bonds............................................. 272 — 272 —

Other Government bonds ...................................... 55 — 55 —

Agency backed bonds ........................................... 28 — 28 —

Corporate bonds .................................................... 434 — 434 —

Mortgage-backed securities .................................. 102 — 102 —

Asset-backed securities ......................................... 19 — 19 —

Pooled funds (a) .................................................... 458 — — —

Other types of investments:

Real estate (a)........................................................ 244 — — —

Hedge funds (a)..................................................... 175 — — —

Private equity (a)................................................... 181 — — —

Derivatives in a positive position.......................... 27 — 27 —

Derivatives in a negative position......................... (38) — (38) —

Total.............................................................................. $ 3,685 $ 344 $ 1,007 $ —

(a) Certain investments that are measured at fair value using the net asset value per share as a practical expedient

have not been classified in the fair value hierarchy. The fair value amounts presented in these tables are intended

to permit reconciliation of the fair value hierarchy to the amounts presented in the fair value of plan assets.

Corporate bonds consist primarily of investment grade bonds of U.S. issuers from diverse industries.

The fair value of certain pooled funds including money market funds, equity securities, fixed income securities, real

estate, hedge funds and private equity investments represents the reported net asset value of shares or underlying assets of

the investment as a practical expedient to estimate fair value. Money market pooled funds invest in high quality, short-term

money market instruments which are issued and payable in U.S. dollars. International equity pooled funds seek to provide

long-term capital growth and income by investing in equity securities of non-U.S. companies located both in developed

and emerging markets. There are generally no redemption restrictions or unfunded commitments related to money market

pooled funds, equity securities or fixed income securities.