Macy's 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-9

MACY’S, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

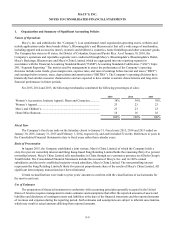

1. Organization and Summary of Significant Accounting Policies

Nature of Operations

Macy’s, Inc. and subsidiaries (the “Company”) is an omnichannel retail organization operating stores, websites and

mobile applications under three brands (Macy’s, Bloomingdale’s and Bluemercury) that sell a wide range of merchandise,

including apparel and accessories (men's, women's and children's), cosmetics, home furnishings and other consumer goods.

The Company has stores in 45 states, the District of Columbia, Guam and Puerto Rico. As of January 30, 2016, the

Company’s operations and reportable segments were conducted through Macy’s, Bloomingdale’s, Bloomingdale’s Outlet,

Macy's Backstage, Bluemercury and Macy's China Limited, which are aggregated into one reporting segment in

accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic

280, “Segment Reporting.” The metrics used by management to assess the performance of the Company’s operating

divisions include sales trends, gross margin rates, expense rates, and rates of earnings before interest and taxes (“EBIT”)

and earnings before interest, taxes, depreciation and amortization (“EBITDA”). The Company’s operating divisions have

historically had similar economic characteristics and are expected to have similar economic characteristics and long-term

financial performance in future periods.

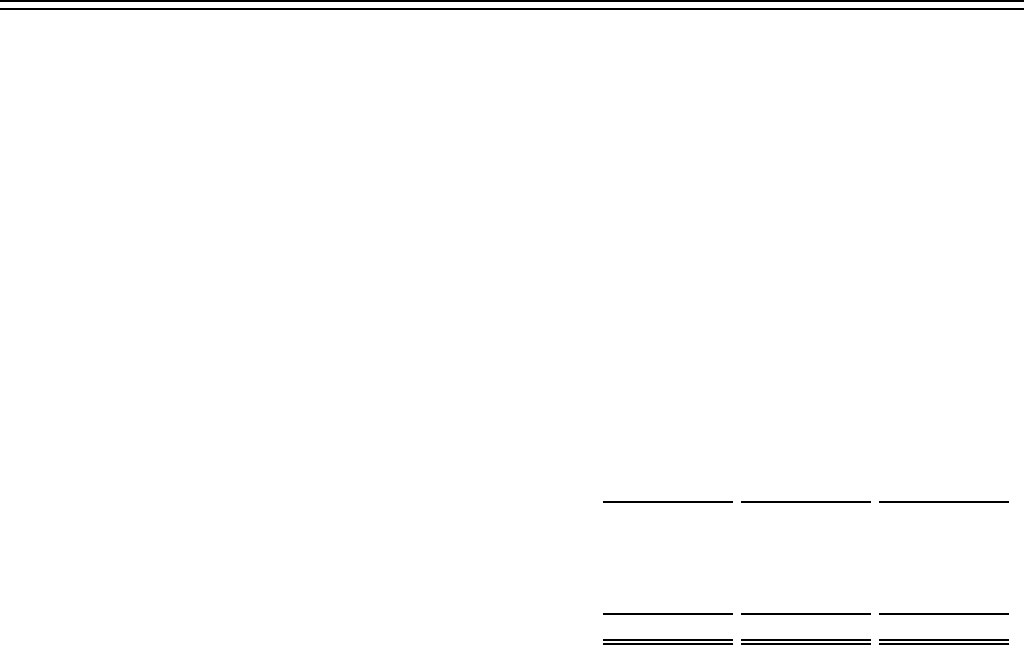

For 2015, 2014 and 2013, the following merchandise constituted the following percentages of sales:

2015 2014 2013

Women’s Accessories, Intimate Apparel, Shoes and Cosmetics.............. 38% 38% 38%

Women’s Apparel..................................................................................... 23 23 23

Men’s and Children’s ............................................................................... 23 23 23

Home/Miscellaneous................................................................................ 16 16 16

100% 100% 100%

Fiscal Year

The Company’s fiscal year ends on the Saturday closest to January 31. Fiscal years 2015, 2014 and 2013 ended on

January 30, 2016, January 31, 2015 and February 1, 2014, respectively, and each included 52 weeks. References to years in

the Consolidated Financial Statements relate to fiscal years rather than calendar years.

Basis of Presentation

In August 2015, the Company established a joint venture, Macy's China Limited, of which the Company holds a

sixty-five percent ownership interest and Hong Kong-based Fung Retailing Limited holds the remaining thirty-five percent

ownership interest. Macy's China Limited sells merchandise in China through an e-commerce presence on Alibaba Group's

Tmall Global. The Consolidated Financial Statements include the accounts of Macy's, Inc. and its 100%-owned

subsidiaries and the newly established majority-owned subsidiary, Macy's China Limited. The noncontrolling interest

respresents the Fung Retailing Limited's thirty-five percent proportionate share of the results of Macy's China Limited. All

significant intercompany transactions have been eliminated.

Certain reclassifications were made to prior years’ amounts to conform with the classifications of such amounts for

the most recent year.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United

States of America requires management to make estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts

of revenues and expenses during the reporting period. Such estimates and assumptions are subject to inherent uncertainties,

which may result in actual amounts differing from reported amounts.