Macy's 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288

|

|

Table of Contents

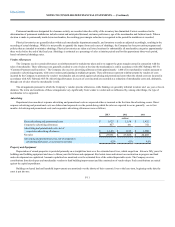

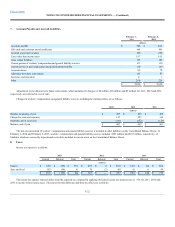

Interest expense and premium on early retirement of debt is as follows:

Interest on debt $407

$449

$ 467

Amortization of debt premium (15)

(19)

(23)

Amortization of financing costs 7

7

8

Interest on capitalized leases 2

3

3

401

440

455

Less interest capitalized on construction 11

15

8

Interest expense $390

$ 425

$447

Premium on early retirement of debt $ —

$137

$ —

On November 28, 2012, the Company repurchased $700 million aggregate principal amount of its outstanding senior unsecured notes, which had a net

book value of $706 million. The repurchased senior unsecured notes had stated interest rates ranging from 5.9% to 7.875% and maturities in 2015 and

2016. The Company recorded the redemption premium and other costs related to these repurchases as additional interest expense of $133 million in 2012. On

March 29, 2012, the Company redeemed the $173 million of 8.0% senior debentures due July 15, 2012, as allowed under the terms of the indenture. The

price for the redemption was calculated pursuant to the indenture and resulted in the recognition of additional interest expense of $4 million in 2012. The

additional interest expense resulting from these transactions is presented as premium on early retirement of debt on the Consolidated Statements of Income.

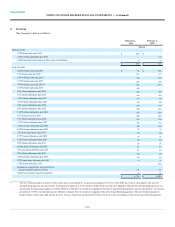

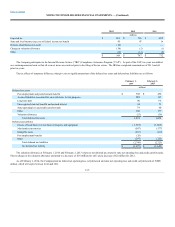

Future maturities of long-term debt, other than capitalized leases and premium on acquired debt, are shown below:

Fiscal year

2015 $ 481

2016 642

2017 306

2018 6

2019 41

After 2019 5,046

During 2013, 2012 and 2011, the Company repaid $109 million, $914 million and $439 million, respectively, of indebtedness at maturity.

On September 6, 2013, the Company issued $400 million aggregate principal amount of 4.375% senior notes due 2023, the proceeds of which were used

for general corporate purposes.

On January 10, 2012, the Company issued $550 million aggregate principal amount of 3.875% senior notes due 2022 and $250 million aggregate

principal amount of 5.125% senior notes due 2042, the proceeds of which were used to retire indebtedness that matured during the first half of 2012.

On November 20, 2012, the Company issued $750 million aggregate principal amount of 2.875% senior unsecured notes due 2023 and $250 million

aggregate principal amount of 4.3% senior unsecured notes due 2043. This debt was used to pay for the notes repurchased on November 28, 2012 described

above, and to retire $298 million of 5.875% senior unsecured notes that matured in January 2013.

F-19