Macy's 2013 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2013 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our company’s momentum continued to build in 2013 as we

drove improvement in Macy’s, Inc.’s financial results, as well as

in the execution of our key strategies. We again outperformed

major competitors across the retail spectrum.

We are most proud of the consistency of our strong

performance, which has led to consecutive year-over-year

increases in sales and earnings, as well as healthy cash flow,

since we unified our organizational structure and began

implementing My Macy’s localization on a nationwide basis

in 2009. In fact, 2013 was our fifth consecutive year of double-

digit growth in earnings per share.

Here are highlights from our fiscal 2013 financial results, which are

presented and discussed in greater detail in the company’s 2013

Form 10-K (including important information on pages 16 to 19

regarding our non-GAAP financial measures):

• Growth of 2.8 percent in comparable sales combined with

comparable sales of departments licensed to third parties.

Comparable sales without comparable sales of departments

licensed to third parties grew by 1.9 percent.

• Adjusted EBITDA as a percent to sales rose to 13.6 percent,

compared with 13.4 percent in 2012. This represents

progress toward the company’s goal of adjusted EBITDA

as a percent to sales of 14 percent. Adjusted EBITDA as a

percent to sales has risen steadily from 11.3 percent in 2009.

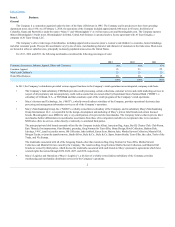

• Earnings per diluted share were $3.86, an increase of

19 percent over $3.24 in 2012. Excluding certain items

(impairments, store closing and other costs in 2013;

impairments, store closing and other costs and premium

on early retirement of debt in 2012), earnings per diluted

share were $4.00 in 2013, an increase of 16 percent from

$3.46 in 2012.

• Return On Invested Capital (ROIC) – a key measure of

how efficiently the company uses its capital – rose again in

2013 to 21.5 percent, up from 21.2 percent in 2012. It was

the fifth consecutive year of improvement in ROIC.

MAJOR ACCOMPLISHMENTS

Beyond our strong financial performance, the company

benefitted in 2013 from a number of significant actions to

support our highly successful core business strategies –

My Macy’s localization, Omnichannel integration and Magic

Selling customer engagement – which are known by the

acronym of M.O.M. Among them:

• We continued to refine and improve the My Macy’s process

for localizing merchandise assortments by store location,

as well as to maximize the effectiveness and efficiency of

the extraordinary talent in our My Macy’s field and central

organization. We have re-doubled the emphasis on precision

in merchandise size, fit, fabric weight, style and color

preferences by store, market and climate zone. In addition,

we are better understanding and serving the specific needs

of multicultural consumers who represent an increasingly

large proportion of our customers.

• Store fulfillment – the process of shipping direct-to-customer

orders that originate online and from other stores – was

expanded to 500 Macy’s locations in 2013. Store fulfillment

was piloted in 2010, rolled out to 23 stores in 2011, then to

292 stores in 2012. We will complete the rollout in spring

2014, when all of our approximately 650 full-line Macy’s

stores will have shipping capability. With store fulfillment,

we are able to leverage the inventory and customer

relationships inherent in our bricks-and-mortar stores in

support of an omnichannel strategy that is being driven

by emerging customer shopping preferences.

• Based on this store fulfillment capability, we successfully

tested Buy Online Pickup In Store in 10 Macy’s locations in

the Washington, D.C., market in fall 2013. This customer

convenience was well-received and will be quickly rolled

out to all Macy’s full-line stores by mid-year 2014.

1

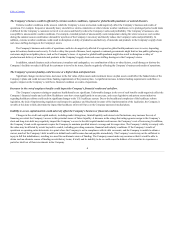

TO OUR SHAREHOLDERS:

$3.46

2012

$2.88

2011

$2.11

2010

$1.36

2009

$4.00

2013

EARNINGS PER DILUTED SHARE

(excluding items, as described above)