Macy's 2013 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2013 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

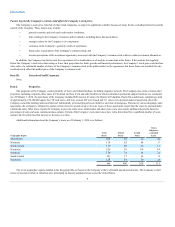

Table of Contents

Dennis J. Broderick has been Secretary of the Company since July 1993 and Executive Vice President and General Counsel of the Company since May

2009; prior thereto he served as Senior Vice President and General Counsel of the Company from January 1990 to April 2009.

In evaluating the Company, the risks described below and the matters described in “Forward-Looking Statements” should be considered carefully. Such

risks and matters are numerous and diverse, may be experienced continuously or intermittently, and may vary in intensity and effect. Any of such risks and

matters, individually or in combination, could have a material adverse effect on the Company's business, prospects, financial condition, results of operations

and cash flows, as well as on the attractiveness and value of an investment in the Company's securities.

The Company faces significant competition in the retail industry.

The Company conducts its retail merchandising business under highly competitive conditions. Although the Company is one of the nation’s largest

retailers, it has numerous and varied competitors at the national and local levels, including conventional and specialty department stores, other specialty

stores, category killers, mass merchants, value retailers, discounters, and Internet and mail-order retailers. Competition may intensify as the Company’s

competitors enter into business combinations or alliances. Competition is characterized by many factors, including assortment, advertising, price, quality,

service, location, reputation and credit availability. Any failure by the Company to compete effectively could negatively affect the Company's business and

results of operations.

The Company’s sales and operating results depend on consumer preferences and consumer spending.

The fashion and retail industries are subject to sudden shifts in consumer trends and consumer spending. The Company’s sales and operating results

depend in part on its ability to predict or respond to changes in fashion trends and consumer preferences in a timely manner. The Company develops new

retail concepts and continuously adjusts its industry position in certain major and private-label brands and product categories in an effort to satisfy

customers. Any sustained failure to anticipate, identify and respond to emerging trends in lifestyle and consumer preferences could negatively affect the

Company’s business and results of operations. The Company’s sales are significantly affected by discretionary spending by consumers. Consumer spending

may be affected by many factors outside of the Company’s control, including general economic conditions, consumer disposable income levels, consumer

confidence levels, the availability, cost and level of consumer debt and consumer behaviors towards incurring and paying debt, the costs of basic necessities

and other goods and the effects of the weather or natural disasters. Any decline in discretionary spending by consumers could negatively affect the Company's

business and results of operations.

The Company’s business is subject to unfavorable economic and political conditions and other developments and risks.

Unfavorable global, domestic or regional economic or political conditions and other developments and risks could negatively affect the Company’s

business and results of operations. For example, unfavorable changes related to interest rates, rates of economic growth, fiscal and monetary policies of

governments, inflation, deflation, consumer credit availability, consumer debt levels, consumer debt payment behaviors, tax rates and policy, unemployment

trends, energy prices, and other matters that influence the availability and cost of merchandise, consumer confidence, spending and tourism could negatively

affect the Company’s business and results of operations. In addition, unstable political conditions, civil unrest, terrorist activities and armed conflicts may

disrupt commerce and could negatively affect the Company’s business and results of operations.

The Company’s revenues and cash requirements are affected by the seasonal nature of its business.

The Company’s business is seasonal, with a high proportion of revenues and operating cash flows generated during the second half of the fiscal year,

which includes the fall and holiday selling seasons. A disproportionate amount of the Company's revenues fall in the fourth fiscal quarter, which coincides

with the holiday season. In addition, the Company incurs significant additional expenses in the period leading up to the months of November and December in

anticipation of higher sales volume in those periods, including for additional inventory, advertising and employees.

5