Macy's 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

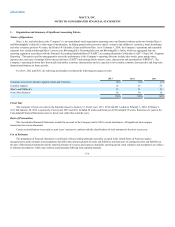

Gift Cards

The Company only offers no-fee, non-expiring gift cards to its customers. At the time gift cards are sold, no revenue is recognized; rather, the Company

records an accrued liability to customers. The liability is relieved and revenue is recognized equal to the amount redeemed at the time gift cards are redeemed for

merchandise. The Company records income from unredeemed gift cards (breakage) as a reduction of SG&A expenses, and income is recorded in proportion

and over the time period gift cards are actually redeemed. At least three years of historical data, updated annually, is used to determine actual redemption

patterns.

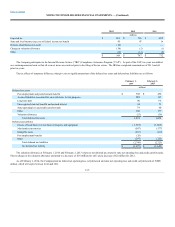

Self-Insurance Reserves

The Company, through its insurance subsidiary, is self-insured for workers compensation and general liability claims up to certain maximum liability

amounts. Although the amounts accrued are actuarially determined based on analysis of historical trends of losses, settlements, litigation costs and other

factors, the amounts the Company will ultimately disburse could differ from such accrued amounts.

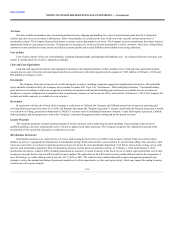

Post Employment and Postretirement Obligations

The Company, through its actuaries, utilizes assumptions when estimating the liabilities for pension and other employee benefit plans. These

assumptions, where applicable, include the discount rates used to determine the actuarial present value of projected benefit obligations, the rate of increase in

future compensation levels, the long-term rate of return on assets and the growth in health care costs. The cost of these benefits is generally recognized in the

Consolidated Financial Statements over an employee’s term of service with the Company, and the accrued benefits are reported in accounts payable and

accrued liabilities and other liabilities on the Consolidated Balance Sheets, as appropriate.

Income Taxes

Income taxes are accounted for under the asset and liability method. Deferred income tax assets and liabilities are recognized for the future tax

consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases, and

net operating loss and tax credit carryforwards. Deferred income tax assets and liabilities are measured using enacted tax rates expected to apply to taxable

income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred income tax assets and liabilities of a

change in tax rates is recognized in the Consolidated Statements of Income in the period that includes the enactment date. Deferred income tax assets are reduced

by a valuation allowance when it is more likely than not that some portion of the deferred income tax assets will not be realized.

Derivatives

The Company records derivative transactions according to the provisions of ASC Topic 815 “Derivatives and Hedging,” which establishes accounting

and reporting standards for derivative instruments and hedging activities and requires recognition of all derivatives as either assets or liabilities and

measurement of those instruments at fair value. The Company makes limited use of derivative financial instruments. The Company does not use financial

instruments for trading or other speculative purposes and is not a party to any leveraged financial instruments. On the date that the Company enters into a

derivative contract, the Company designates the derivative instrument as either a fair value hedge, a cash flow hedge or as a free-standing derivative

instrument, each of which would receive different accounting treatment. Prior to entering into a hedge transaction, the Company formally documents the

relationship between hedging instruments and hedged items, as well as the risk management objective and strategy for undertaking various hedge transactions.

Derivative instruments that the Company may use as part of its interest rate risk management strategy include interest rate swap and interest rate cap

agreements and Treasury lock agreements. At February 1, 2014, the Company was not a party to any derivative financial instruments.

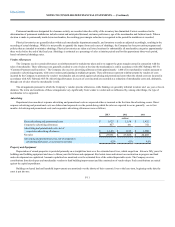

Stock Based Compensation

The Company records stock-based compensation expense according to the provisions of ASC Topic 718, “Compensation – Stock Compensation.”

ASC Topic 718 requires all share-based payments to employees, including grants of employee stock options, to be recognized in the financial statements

based on their fair values. Under the provisions of ASC Topic 718, the Company determines the appropriate fair value model to be used for valuing share-

based payments and the amortization method for compensation cost.

F-13