Macy's 2013 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2013 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

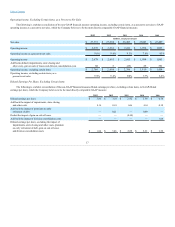

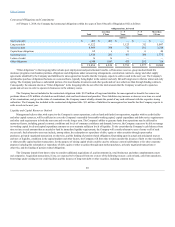

Contractual Obligations and Commitments

At February 1, 2014, the Company had contractual obligations (within the scope of Item 303(a)(5) of Regulation S-K) as follows:

Short-term debt $ 461

$ 461

$ —

$ —

$ —

Long-term debt 6,522

—

1,123

312

5,087

Interest on debt 4,909

398

712

581

3,218

Capital lease obligations 62

4

6

6

46

Operating leases 2,920

282

477

386

1,775

Letters of credit 34

34

—

—

—

Other obligations 4,548

3,047

475

292

734

$19,456

$4,226

$2,793

$1,577

$ 10,860

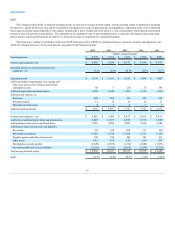

“Other obligations” in the foregoing table includes post employment and postretirement benefits, self-insurance reserves, group medical/dental/life

insurance programs, merchandise purchase obligations and obligations under outsourcing arrangements, construction contracts, energy and other supply

agreements identified by the Company and liabilities for unrecognized tax benefits that the Company expects to settle in cash in the next year. The Company's

merchandise purchase obligations fluctuate on a seasonal basis, typically being higher in the summer and early fall and being lower in the late winter and early

spring. The Company purchases a substantial portion of its merchandise inventories and other goods and services otherwise than through binding contracts.

Consequently, the amounts shown as “Other obligations” in the foregoing table do not reflect the total amounts that the Company would need to spend on

goods and services in order to operate its businesses in the ordinary course.

The Company has not included in the contractual obligations table $147 million of long-term liabilities for unrecognized tax benefits for various tax

positions taken or $51 million of related accrued federal, state and local interest and penalties. These liabilities may increase or decrease over time as a result

of tax examinations, and given the status of examinations, the Company cannot reliably estimate the period of any cash settlement with the respective taxing

authorities. The Company has included in the contractual obligations table $31 million of liabilities for unrecognized tax benefits that the Company expects to

settle in cash in the next year.

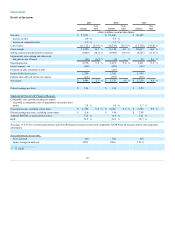

Liquidity and Capital Resources Outlook

Management believes that, with respect to the Company's current operations, cash on hand and funds from operations, together with its credit facility

and other capital resources, will be sufficient to cover the Company's reasonably foreseeable working capital, capital expenditure and debt service requirements

and other cash requirements in both the near term and over the longer term. The Company's ability to generate funds from operations may be affected by

numerous factors, including general economic conditions and levels of consumer confidence and demand; however, the Company expects to be able to manage

its working capital levels and capital expenditure amounts so as to maintain sufficient levels of liquidity. To the extent that the Company's cash balances from

time to time exceed amounts that are needed to fund its immediate liquidity requirements, the Company will consider alternative uses of some or all of such

excess cash. Such alternative uses may include, among others, the redemption or repurchase of debt, equity or other securities through open market

purchases, privately negotiated transactions or otherwise, and the funding of pension related obligations. Depending upon its actual and anticipated sources

and uses of liquidity, conditions in the capital markets and other factors, the Company will from time to time consider the issuance of debt or other securities,

or other possible capital markets transactions, for the purpose of raising capital which could be used to refinance current indebtedness or for other corporate

purposes including the redemption or repurchase of debt, equity or other securities through open market purchases, privately negotiated transactions or

otherwise, and the funding of pension related obligations.

The Company intends from time to time to consider additional acquisitions of, and investments in, retail businesses and other complementary assets

and companies. Acquisition transactions, if any, are expected to be financed from one or more of the following sources: cash on hand, cash from operations,

borrowings under existing or new credit facilities and the issuance of long-term debt or other securities, including common stock.

26