Macy's 2013 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2013 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

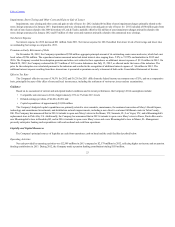

The credit agreement requires the Company to maintain a specified interest coverage ratio for the latest four quarters of no less than 3.25 and a specified

leverage ratio as of and for the latest four quarters of no more than 3.75. The Company's interest coverage ratio for 2013 was 9.40 and its leverage ratio at

February 1, 2014 was 1.85, in each case as calculated in accordance with the credit agreement. The interest coverage ratio is defined as EBITDA over net

interest expense and the leverage ratio is defined as debt over EBITDA. For purposes of these calculations EBITDA is calculated as net income plus interest

expense, taxes, depreciation, amortization, non-cash impairment of goodwill, intangibles and real estate, non-recurring cash charges not to exceed in the

aggregate $400 million and extraordinary losses less interest income and non-recurring or extraordinary gains. Debt is adjusted to exclude the premium on

acquired debt and net interest is adjusted to exclude the amortization of premium on acquired debt and premium on early retirement of debt.

A breach of a restrictive covenant in the Company's credit agreement or the inability of the Company to maintain the financial ratios described above

could result in an event of default under the credit agreement. In addition, an event of default would occur under the credit agreement if any indebtedness of the

Company in excess of an aggregate principal amount of $150 million becomes due prior to its stated maturity or the holders of such indebtedness become able

to cause it to become due prior to its stated maturity. Upon the occurrence of an event of default, the lenders could, subject to the terms and conditions of the

credit agreement, elect to declare the outstanding principal, together with accrued interest, to be immediately due and payable.

Moreover, most of the Company's senior notes and debentures contain cross-default provisions based on the non-payment at maturity, or other default

after an applicable grace period, of any other debt, the unpaid principal amount of which is not less than $100 million, that could be triggered by an event of

default under the credit agreement. In such an event, the Company's senior notes and debentures that contain cross-default provisions would also be subject to

acceleration.

At February 1, 2014, no notes or debentures contain provisions requiring acceleration of payment upon a debt rating downgrade. However, the terms of

approximately $3,700 million in aggregate principal amount of the Company's senior notes outstanding at that date require the Company to offer to purchase

such notes at a price equal to 101% of their principal amount plus accrued and unpaid interest in specified circumstances involving both a change of control

(as defined in the applicable indenture) of the Company and the rating of the notes by specified rating agencies at a level below investment grade.

The rate of interest payable in respect of $407 million in aggregate principal amount of the Company's 7.875% senior notes outstanding at February 1,

2014 could increase by up to 2.0 percent per annum from its current level in the event of two or more downgrades of the notes by specified rating agencies.

The Company's board of directors approved an additional authorization to purchase Common Stock of $1,500 million on May 15, 2013. During 2013,

the Company repurchased approximately 33.6 million shares of its common stock for a total of $1,570 million. As of February 1, 2014, the Company had

$1,432 million of authorization remaining under its share repurchase program. The Company may continue or, from time to time, suspend repurchases of

shares under its share repurchase program, depending on prevailing market conditions, alternate uses of capital and other factors.

On February 28, 2014, the Company's board of directors declared a quarterly dividend of 25 cents per share on its common stock, payable April 1,

2014 to Macy's shareholders of record at the close of business on March 14, 2014.

25